Aerospace & Defense

Let's assume though that even if the Democrats were to take over, that military policy in Iraq, Afghanistan and elsewhere will be relatively unchanged. If that's the case, then it might make sense to look to the A&D sector for alpha. We have sixteen companies within this sector, with ten currently “buy” recommended, three “neutral” recommended and three “sell” recommended. Our highest-rated A&D company today is Sequa Corp. (SQA-A 10/5/06) which is up nearly 11% since the “buy” recommendation.

Other companies of note today include: Curtiss-Wright Corp. (CW 10/20/06), Precision Castparts Corp. (PCP 9/20/06) and Triumph Group Inc. (TGI 10/30/06).

Other companies of note today include: Curtiss-Wright Corp. (CW 10/20/06), Precision Castparts Corp. (PCP 9/20/06) and Triumph Group Inc. (TGI 10/30/06). An interesting A&D company just beginning its bullish trend in October is Kaman Corp. (KAMN 10/26/06).

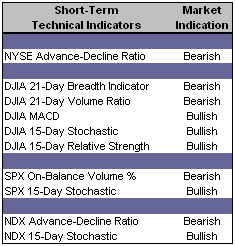

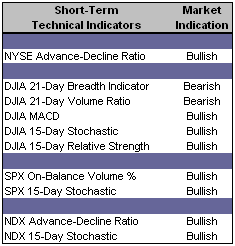

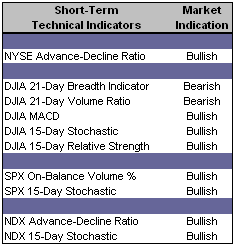

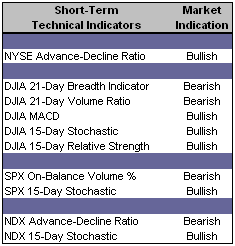

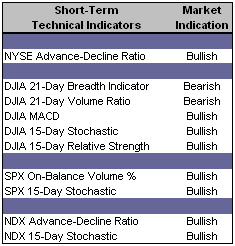

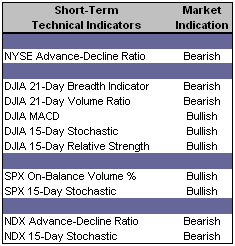

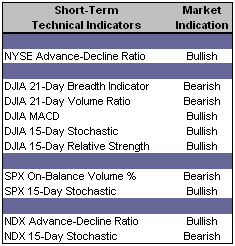

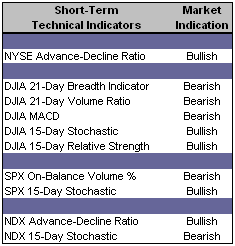

Short-Term Technical Indicators – The DJIA MACD crossed below its 9-Day Moving Average, which typically reflects the development of a short-term bearish trend.

Short-Term Technical Indicators – The DJIA MACD crossed below its 9-Day Moving Average, which typically reflects the development of a short-term bearish trend. Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX has edged higher ever so slightly for three days in a row and is again trading above last week’s level.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall investment portfolio.

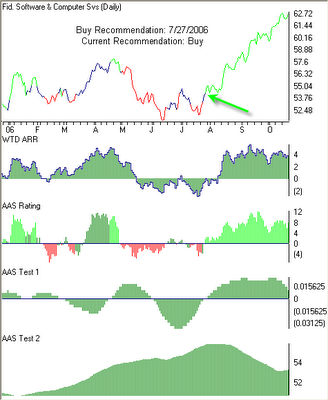

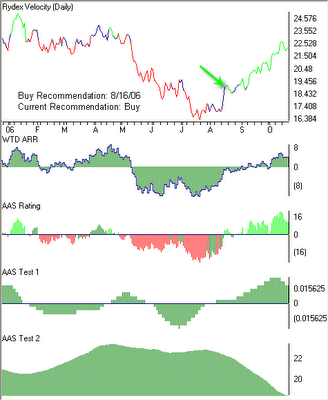

Date = Date of AAS “Buy” Recommendation

Top Rated Major Market Derivative – Russell 2000 (IWM 10/9/06)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ 10/9/06)

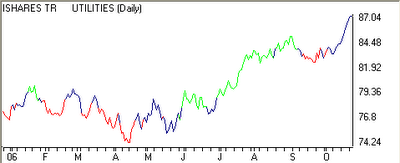

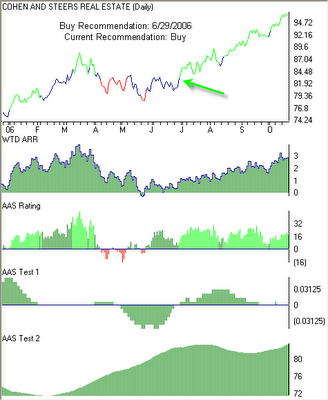

Top Rated Sector Derivative – iShares Dow Jones Real Estate (IYR 6/30/06)

Today’s Top “Buy” Recommended Stocks

- OM Group Inc. (OMG 8/11/06)

- Allegheny Technologies Inc. (ATI 10/5/06)

- Harman International Industries Inc. (HAR 10/9/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Centene Corp. (CNC 10/20/06)

- Sears Holdings Corp. (SHLD 9/19/06)

- Manitowoc Co. Inc (MTW 8/10/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- Veritas DGC Inc. (VTS 7/28/06)

- Piper Jaffray Companies (PJC 10/4/2006)

- Apollo Group Inc. (APOL 10/13/06)

- Carbo Ceramics Inc. (CRR 2/7/06)

- Legg Mason Inc. (LM 10/11/06)

- Express Scripts Inc. (ESRX 9/22/06)

- Universal Forest Products Inc. (UFPI 5/24/06)