Whether it was Alan Greenspan’s comments late in trading session Wednesday when he stated that the lofty level of the Chinese equity markets is unsustainable or investor's preparing for the long Memorial Day weekend, this week the Bull’s clearly elected to take their profits and go to the shore for a well deserved three day break. In Friday’s slow pre-holiday trading session, stocks recovered some ground from Thursday’s declines aided by yet another wave of M&A activity which re-ignited positive moods among investors. The DJIA gained 66.15 points (+0.49%) to close at 13507.28. The S&P 500 gained 8.22 points (+0.55%) at 1515.73 while the NASDAQ rose 19.27 points (+0.76%) to close at 2557.19.

However, Friday’s gains were not enough to make up the losses from the previous four trading days. All three major indexes were down for the week. The DJIA had its seven week winning streak snapped, down 0.36% for the week. The S&P 500 declined 0.46% for the week after failing to break its previous closing record on multiple tries. The NASDAQ declined for a third straight week closing at and was off 0.05% for the week.

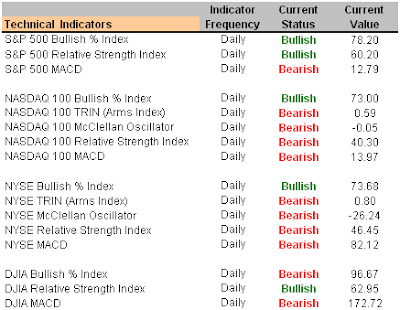

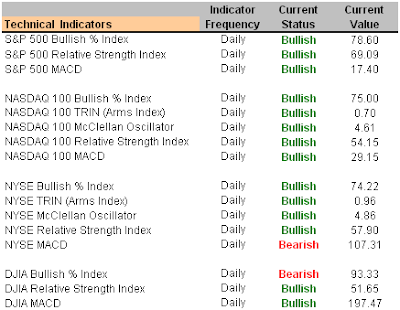

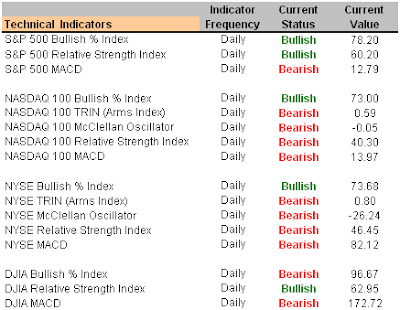

This week’s declines were also reflected in the continued weakening in the Technical Indicators which our Major Market Model follows. The NYSE advance/decline line was lower for a second week in a row. Although new highs continue to outnumber new lows on both the NYSE and the NASDAQ, the number of new highs continued to decline. A shift from large cap to small cap dominance is of significant importance to our model and the small cap Russell 2000 index outperformed other major indexes gaining 0.76% for the week.

Bond prices edged down Friday after this week’s news releases of new home sales, durable goods and jobless claims reports suggested the Federal Reserve will not cut interest rates in the near future. The five-year note fell 3/32 to yield 4.80 percent. The benchmark 10-year note slipped 5/32 to yield 4.86 percent and the 30-year bond was down 6/32 to yield 5.00 percent.

In currency trading, the Euro bought at $1.3430, down from $1.3460 late Wednesday. The greenback traded at ¥121.42, down from ¥121.65 in the previous session.

The AAS Market Model turned Bearish as of the close Tuesday, May 15, 2007. The total universe of stocks, ETF’s and mutual funds which we review on a daily basis is 1831. Of those reviewed, 568 are rated "Buy," 687 are rated "Sell" and 576 "Neutral”. The recommended allocation in the Model Fund Portfolio’s is 50% invested and 50% in cash, while in the Model Stock Portfolio the allocations have been reduced as individual securities lose their directional trend or violate an internal Sell rule.

The tone for the coming week will be set by the heavy dose of the economic data scheduled to be released which will give investors something new to digest. The FOMC meeting minutes will be released on Wednesday. The Q1 preliminary GDP is due on Thursday. And the most important data for the week is probably going to be the May employment report due out on Friday.

A quick review of our AAS market analysis indicates that the Large Cap holdings are leading the market of late with Large Cap Value being the style of choice. However, interestingly we see Small Cap Growth again begin to emerge as a Style leader after having slowed down over the past several months. This supports the shift taking place in our market model mentioned above.

Currently we are rating six of the ten S&P Sectors as AAS Buy’s led by Energy Select Sector SPDR (XLE), iShares S&P Global Telecom (IXP), Industrial SPDR (XLI), Technology SPDR (XLK), Materials SPDR (XLB) and Health Care SPDR (XLV).

Alpha Generating Equities to look at from within these sectors include:

Telecommunications: Cincinnati Bell Inc. (CBB), Embarq Corp (EQ), Verizon (VZ), Qwest Communication International (Q) and Sprint Nextel (S).

Energy: W-H Energy Services Inc (WHQ), Hornbeck Offshore Services Inc. (HOS), Peabody Energy Corp (BTU), Bristow Group Inc (BRS), Ashland Coal Inc (ACI).

Basic Materials: OM Group Inc (OMG), Chaporral Steel (CHAP), Reliance Steel and Aluminum Co (RS), Lyondell Chemical Co (LYO) and Alcoa Aluminum (AA).

Industrials: Barnes Group Inc (B), Armor Holdings (AH), Woodward Governor Co (WGOV), Edo Corporation (EDO) and KBR INC (KBR).

Health Care: Cryolife Inc (CRY), Chemed Corp (CHE), Bausch & Lomb Inc (BOL), Schering Plough Corp (SGP) and PDL Biopharma Inc (PDLI).

Technology: Novatel Wireless Inc (NVTL), Phoenix Technologies Ltd (PTEC), Acxiom Corp (ACXM), Maximus Inc (MMS) and Commscope Inc (CTV).

Current ProFund mutual funds that match up with these sectors would include: ProFund Ultra Sector Oil & Gas (ENPIX), ProFund Ultra Sector Telecom (TCPIX), ProFund Ultra Sector Basic Materials (BMPIX), ProFund Ultra Sector Industrials (IDPIX) and ProFund Ultra Sector Pharmaceuticals (PHPIX).

Several Fidelity funds which are currently rated AAS Buy and are from within these sectors include: Fidelity Select Energy Service (FSESX), Fidelity Select Telecommunications (FSTCX), Fidelity Select Natural Resources (FNARX), Fidelity Select Materials (FSDPX) or Fidelity Select Chemicals (FSCHX).

The Rydex family currently has only three members which are rated AAS Buy and are from within these alpha generating sectors including: Rydex Energy Services (RYVIX), Rydex Basic Materials (RYBIX) and the Rydex Telecommunications (RYMIX) fund.

Additional information on our firm may be found by clicking the following link, Alpha Advisor Service, LLC. Information concerning the availability of our newsletter is available by clicking AAS Information. Questions may be submitted to info@Alpha-Advisor.com.

Short-Term Technical Indicators

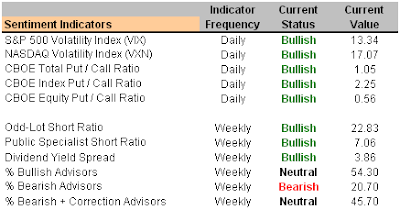

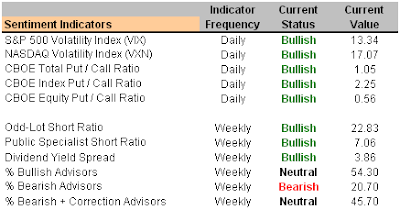

Investor Sentiment

Long-Term Market Model – Bearish since May 15, 2007

Asset Allocation Recommendation – AAS Model Portfolios are allocated at 50% cash and 50% long.

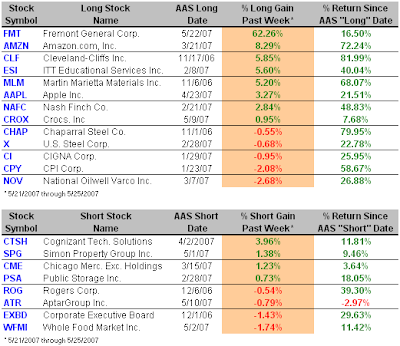

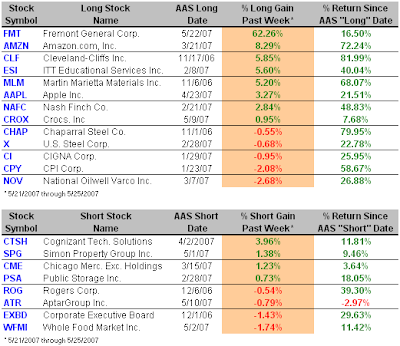

Top Alpha Generating Securities

Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top AAS Rated Major Market – Diamonds Trust, Series 1 (DIA 5/3/07)

Top AAS Rated Style-Box for Alpha – iShares Morningstar Large Cap Value (JKF 5/3/07)

Top AAS Rated Sector for Alpha – iShares Dow Jones U.S. Energy (IYE 3/19/07)

Top AAS Rated Long Stocks for Alpha

Crocs, Inc. (CROX 5/9/07)

CPI Corp. (CPY 1/23/07)

Amazon.com, Inc. (AMZN 3/21/07)

ITT Educational Service Inc. (ESI 2/8/07)

Cleveland-Cliffs Inc. (CLF 11/17/06)

Martin Marietta Materials Inc. (MLM 11/6/06)

Apple Inc. (AAPL 4/24/07)

Chemed Corp. (CHE 3/8/07)

Chaparral Steel Co. (CHAP 11/1/06)

CIGNA Corp. (CI 1/29/07)

Top AAS Rated Short Stocks for Alpha

Chicago Mercantile Exchange (CME 3/15/07)

Public Storage Inc. (PSA 2/28/07)

Cognizant Technology Solutions Corp. (CTSH 4/2/07)

Rogers Corp. (ROG 12/6/06)

Komag Inc. (KOMG 12/11/06)

Review of Last Week’s Top AAS Rated Stocks