Alpha Moving to Defensive Sectors

We’re seeing alpha generation within several defensive “buy” recommended sectors such as Real Estate (IYR 6/30/06) and Transportation (IYT 10/5/06). We’re also seeing alpha within several “neutral” recommended sectors such as Utilities (IDU), Natural Resources (IGE) and Healthcare (IYH).

I noted strength in transports back on October 6th and pointed out companies such as Alaska Air Group Inc. (ALK 9/25/06), Burlington Northern Santa-Fe Corp. (BNI 9/29/06), and CSX Corp. (CSX 10/3/06) as companies generating alpha. Other “buy” recommended transportation companies generating alpha are Norfolk Southern Corp. (NSC 10/5/06), Frontier Airlines Holdings Inc. (FRNT 10/19/06) and JetBlue Airways Corp. (JBLU 10/17/06), with the last two recently upgraded.

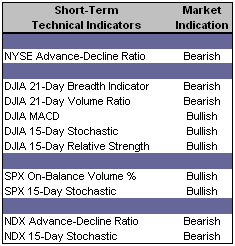

Short-Term Technical Indicators – The short-term indicators continue to shift with a bias on the bearish side. Both NASDAQ indictors are weakening.

Short-Term Technical Indicators – The short-term indicators continue to shift with a bias on the bearish side. Both NASDAQ indictors are weakening. However, the S&P 500 On-Balance Volume % indicator jumped to its highest value since December 2, 2005. This is somewhat surprising considering the value was beginning to trend down over the last week or so. You can tell from the graph that after December 2, 2005, the S&P 500 edged slightly higher but was basically range-bound through the spring of 2006.

However, the S&P 500 On-Balance Volume % indicator jumped to its highest value since December 2, 2005. This is somewhat surprising considering the value was beginning to trend down over the last week or so. You can tell from the graph that after December 2, 2005, the S&P 500 edged slightly higher but was basically range-bound through the spring of 2006. Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The bears are getting restless and rightfully so. The VIX, at 10.63 on Friday, is only 0.36 away from its 52-week low. The VXN also slipped lower on Friday to 16.70.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall investment portfolio.

Top Rated Major Market Derivative – Fidelity NASDAQ Composite Index Tracking (ONEQ 8/30/06)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ 10/9/06)

Top Rated Sector Derivative – iShares Dow Jones U.S. Real Estate (IYR 6/30/06)

Today’s Top “Buy” Recommended Stocks

- Allegheny Technologies Inc. (ATI 10/5/06)

- CPI Corp. (CPY 4/19/06)

- RTI International Metals Inc. (RTI 10/11/06)

- JLG Industries Inc. (JLG 9/26/06)

- Sears Holdings Corp. (SHLD 9/19/06)

- Granite Construction Inc. (GVA 7/28/06)

- Gymboree Corp. (GYMB 9/28/06)

- Veritas DGC Inc. (VTS 7/28/06)

- Piper Jaffray Companies (PJC 10/4/06)

- Sequa Corp. (SQA-A 10/5/06)

0 Comments:

Post a Comment

<< Home