Not wanting to miss the boat in the last week of the year, investors sought to allocate into the rally and squeeze out any remaining gains before the books are wiped clean next week. The buying frenzy coupled with good economic news drove the markets higher yet again. The Dow Jones Industrial Average vaulted 102.94 points, or 0.83 percent, to end at a record 12,510.57. The S&P 500 Index surged 9.94 points, or 0.70 percent, to finish at 1,426.84 and the NASDAQ Composite Index added 17.71 points, or 0.73 percent, to close at 2,431.22. With only a few trading days left for 2006, all three major U.S. stock indexes are in good position to end the year with double-digit gains. Certainly investors should take into consideration end of year “window dressing” when examining the underpinnings of the recent rally. How sound are the gains of late with such low, albeit seasonal, volume? On the NYSE, only about 974.7 million shares were traded on Wednesday, well below last year’s daily average of 1.61 billion. Advancing issues outnumbered decliners by about 7 to 2. Conversely, on the NASDAQ, about 1.26 billion shares were traded, again significantly below last year's daily average of 1.80 billion, with an advance-decline ratio of 5 to 2.

The commodity market was mixed, with forecasts of continued mild weather offsetting geopolitical concerns between the West and Iran. U.S. crude oil for February delivery fell 76 cents, or 1.2 percent, to settle at $60.34 per barrel. January heating oil fell 1.45 cents, or 0.9 percent, to $1.6088 a gallon while January unleaded gasoline was up 1.53 cents at $1.5875 a gallon. COMEX February gold, however, added $3.40 to end at $630.30 an ounce.

Better than expected news from the Commerce Department, which reported new home sales up 3.4 percent in November, jumpstarted the market. Much to the chagrin of those still on the short-side of the homebuilders sector, the Dow Jones U.S. Home Construction Index ended the session up 1.9 percent. Several big name homebuilder companies ended higher, with shares of Lennar Corp. (LEN) up 2.7 percent while Toll Brothers (TOL) gained 1.9 percent.

The news casts doubt on whether the Fed will cut rates in early ’07, which in turn drove U.S. Treasury prices down and yields up. The 10-year Treasury note ended at 4.59 percent. Thirty-year bonds closed at 4.72 percent, five-year notes at 4.56 percent, and two-year notes at 4.71 percent. Looking at short-term rate futures, the implied chances for a first-quarter Fed cut retreated from 18 percent to 14 percent.

Global markets rallied as well; several indexes closing at all time highs including the MSCI All-Country World Index at 368.6 points, Hong Kong's Hang Seng at 20,001.91, and Australia's S&P/ASX 200 at 5,673.7 points. The MSCI Asia Ex-Japan Index ended higher by 0.7 percent, the Nikkei Average was up 0.01 percent and the TOPIX Index was up 0.12 percent at 1,678.91. In Europe, the FTSEurofirst 300 Index was flat early Thursday while Germany's DAX reached 6,625.55 points.

Wachovia Securities sees energy as the only significant sector opportunity for 2007.

Daily link fest from Abnormal Returns.

Barry Ritholtz on the significance of a 2% correction.

Are mutual funds soon to be obsolete?

Adam begins a discussion of option lingo.

Larry delves into the new tax law.

Excellent insight on trading from Dr. Brett.

Lindsay and crew on Adobe (ADBE)

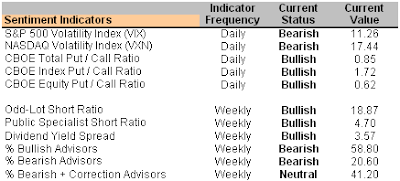

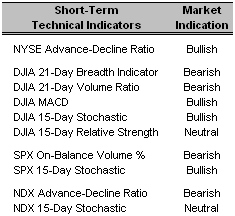

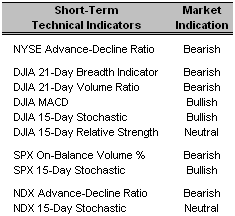

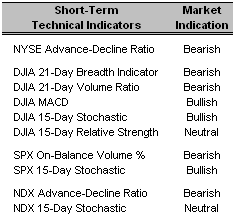

Short-Term Technical Indicators

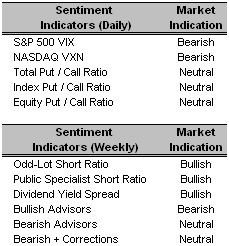

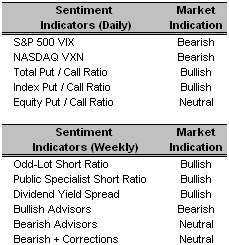

Investor Sentiment

Long-Term Market Model – Bearish since December 8th.

Asset Allocation – Between 66.6% and 75% long within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

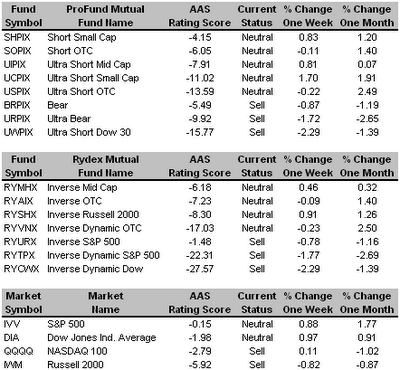

Beta Exposure and Portable Alpha Generation

Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – NYSE 100 (NYC 11/6/06)

Top Rated Style-Box Derivative – iShares Morningstar Large Cap Value (JKF 11/29/06)

Top Rated Sector Derivative – No "Buy" recommended sectors today.

Today’s Top “Buy” Recommended Stocks

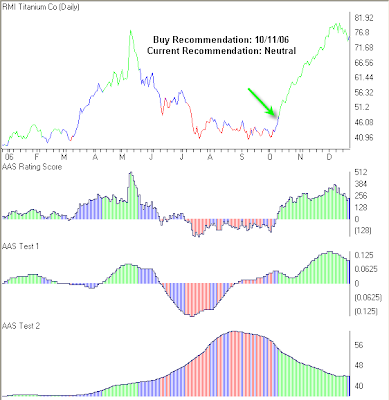

RTI International Metals Inc. (RTI 10/11/06)

Alleghany Technologies Inc. (ATI 10/5/06)

Veritas DGC Inc. (VTS 7/28/06)

Volt Information Sciences, Inc. (VOL 11/6/06)

Robbins & Myers Inc. (RBN 8/10/06)

Daktronics Inc. (DAKT 10/31/06)

NBTY, Inc. (NTY 12/5/06)

Deckers Outdoor Corp. (DECK 9/7/06)

Albemarle Corp. (ALB 8/9/06)

Joy Global Inc. (JOYG 11/13/06)

Today’s Top “Sell” Recommended Stocks

CONSOL Energy Inc. (CNX 12/15/06)

Chicago Mercantile Exchange Holdings (CME 12/18/06)

Intuitive Surgical Inc. (ISRG 12/19/06)

Whole Foods Market, Inc. (WFMI 11/2/06)

Chico’s FAS Inc. (CHS 12/6/06)