Mid-Week Alpha

However, that’s not to say investors should tuck tail and run, as there are opportunities for alpha present. We continue to recommend caution and discretion in portfolio allocations, thoughtful selection of entry points and disciplined stop loss limits. Perhaps even more appropriate would be utilizing long / short strategies, correlated and non-correlated pairs trading or inverse mutual funds and ETF’s, which can be used to hedge long market exposure. Both the AAS Model ProFund and Rydex portfolio have been 50% allocated among inverse funds for the last several weeks, with one-month returns for those portfolios at 3.41% and 1.04% respectively versus -9.39% for the S&P 500.

Additional information on our firm may be found by clicking the following link, Alpha Advisor Service, LLC. Information concerning the availability of our newsletter is available by clicking AAS Information. Questions may be submitted to info@Alpha-Advisor.com.

Short-Term Technical Indicators

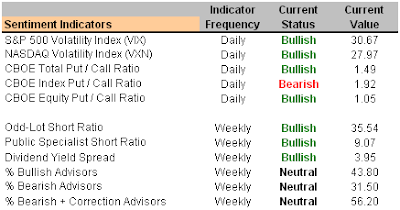

Investor Sentiment

Long-Term Market Model – Bearish since May 15, 2007

Asset Allocation Recommendation – AAS Model Portfolios are allocated between 50-77% cash and 0-50% long.

Top Alpha Generating Securities

Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Blue Coat Systems Inc. (BCSI 3/1/07)

Oceaneering International (OII 3/19/07)

IDEXX Laboratories Inc. (IDXX 7/18/07)

FLIR Systems Inc. (FLIR 3/12/07)

SurModics, Inc. (SRDX 7/19/07)

ArthoCare Corp. (ARTC 5/29/07)

Vertex Pharmaceuticals Inc. (VRTX 8/8/07)

The Corporate Executive Board Co. (EXBD 8/7/70)

Biogen Idec Inc. (BIIB 5/29/07)

Daktronics Inc. (DAKT 8/7/70)

Radian Group Inc. (RDN 6/7/07)

Beazer Homes USA Inc. (BZH 1/25/07)

LandAmerica Financial Group (LFG 7/11/07)

U.S. Steel Corp. (X 7/20/07)

Meritage Homes Corp. (MTH 10/31/06)

0 Comments:

Post a Comment

<< Home