Long-Short Equity Strategies

As the name suggests, Long / Short strategies involve allocating a specific percentage to those securities believed to go up while allocating another percentage to those believed to go down. This approach can be utilized with broad-market vehicles such as index-correlated ETF’s, down through sector-specific instruments and then finally individual securities. When done correctly, Long / Short strategies provide absolute returns with low correlation (beta) to the benchmark. Porting these returns onto the benchmark of your choice produces portable alpha.

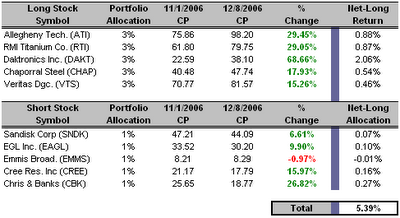

This week I’m going to focus my posts on how to incorporate Long / Short strategies into a portfolio. Let’s start with a look at the securities listed below. With the exception of Emmis Communications Corp. (EMMS) the top five “buy” and “sell” recommended stocks all have initial buy-dates of November 1st or earlier. So for the sake of discussion, we’ll move the recommended short/sell date of EMMS back to November 1st and analyze how a Long / Short strategy might have performed since then.

With our Long-Term Market Model bullish the entire month of November, we might have a Long / Short allocation in the neighborhood of 15% long and 5% short. In other words, each of the long equities would have a 3% allocation and each of the short equities would have a 1% allocation. Doing so would produce a return of 5.39% (gross any trading commissions or margin expenses). That’s not bad at all considering a return like that would have outperformed the S&P 500, the Russell 2000 and the Wilshire 5000.

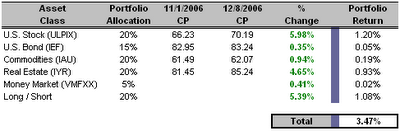

Overlay the Long / Short equity strategy onto the asset classes of your choice, and you’ve got a solid portable alpha portfolio.

Overlay the Long / Short equity strategy onto the asset classes of your choice, and you’ve got a solid portable alpha portfolio. Now that our Long-Term Market Model is bearish, we might consider a more net-neutral allocation with 10% long and 10% short. Assuming the market weakens further and a bearish trend develops, we would then reduce the long allocation even further to 5% with the short allocation increased to 15%.

Now that our Long-Term Market Model is bearish, we might consider a more net-neutral allocation with 10% long and 10% short. Assuming the market weakens further and a bearish trend develops, we would then reduce the long allocation even further to 5% with the short allocation increased to 15%.Wednesday’s post will take a look at how a Long / Short strategy can be utilized with sector ETF’s.

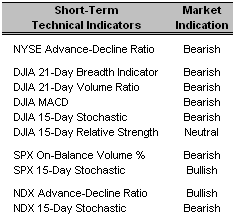

Short-Term Technical Indicators – Friday saw further declines in the 21-Day Breadth and Volume indicators as well as the MACD, 15-Day Stochastic and 15-Day Relative Strength indicators. Despite the index gaining over 29 points, the indicators continue to regress into bearish territory. The S&P 500 and NASDAQ also saw continued weakness in their respective 15-Day Stochastic indicators.

Long-Term Market Model – Bearish since December 8th.

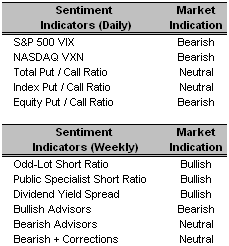

Long-Term Market Model – Bearish since December 8th.Investor Sentiment – Both the VIX and VXN lost a little ground as did the Equity Put / Call Ratio.

Looking at the weekly sentiment indicators, the Odd-Lot Short Ratio strengthened for the third straight week. Conversely, the Dividend Yield Spread and the Public Specialist Short Ratio weakened, yet both are still well defined bullish indications.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – iShares Russell 2000 (IWM 11/6/06)

Top Rated Style-Box Derivative – iShares Morningstar Mid Cap Growth (JKH 11/8/06)

Top Rated Sector Derivative – iShares Dow Jones Energy (IYE 11/10/06)

Today’s Top “Buy” Recommended Stocks

- Alleghany Technologies Inc. (ATI 10/5/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Daktronics Inc. (DAKT 10/31/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- Veritas DGC Inc. (VTS 7/28/06)

- Manitowoc Company Inc. (MTW 8/10/06)

- Robbins & Myers Inc. (RBN 8/10/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Albemarle Corp. (ALB 8/9/06)

- Nucor Corp. (NUE 11/21/06)

0 Comments:

Post a Comment

<< Home