Out of Town

I’ll update the blog sometime on Sunday hopefully with the AAS Top Ten from October 20, 2006. Until then, have a great weekend!

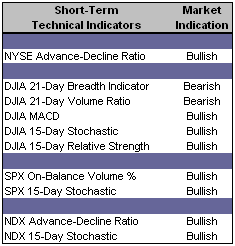

Short-Term Technical Indicators – NASDAQ and S&P technicals are bullish, but the Dow is still questionable as long as the Breadth and Volume indicators remain bearish.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – All five sentiment indicators continue to trade in the basement. The VIX is at its fourth lowest level of the year and only .29 away from its 52-week low of 10.27 occurring on December 23, 2005.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall investment portfolio.

Date = Date of AAS “Buy” or "Sell" Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Tracking (ONEQ 8/30/06)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ 10/9/06)

Top Rated Sector Derivative – iShares Dow Jones Real Estate (IYR 6/30/06)

Today’s Top “Buy” Recommended Stocks

- OM Group Inc. (OMG 8/11/06)

- Allegheny Technologies Inc. (ATI 10/5/06)

- Harman International Industries Inc. (HAR 10/9/06)

- Sears Holdings Corp. (SHLD 9/19/06)

- Centene Corp. (CNC 10/20/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Veritas DGC Inc. (VTS 7/28/06)

- Gymboree Corp. (GYMB 9/28/06)

- Piper Jaffray Companies (PJC 10/4/2006)

- Apollo Group Inc. (APOL 10/13/06)

- Legg Mason Inc. (LM 10/11/06)

- Carbo Ceramics Inc. (CRR 2/7/06)

- Express Scripts Inc. (ESRX 9/22/06)

- Universal Forest Products Inc. (UFPI 5/24/06)

0 Comments:

Post a Comment

<< Home