Alpha in Steel

Looking at Today’s Top “Buy” Recommended Stocks at the bottom of this post, three of the top four are steel oriented including:

Carpenter Technology Corp. (CRS 10/5/06) is getting hammered today, although I’m not exactly sure why. I’ll read the release later on, but analysts didn’t like something in today’s earnings call apparently. We’ll see what happens within our analytic as a result of today’s activity, but CRS might still be worth looking at despite today, especially if it only shifts down to a “neutral” instead of a “sell.”

Carpenter Technology Corp. (CRS 10/5/06) is getting hammered today, although I’m not exactly sure why. I’ll read the release later on, but analysts didn’t like something in today’s earnings call apparently. We’ll see what happens within our analytic as a result of today’s activity, but CRS might still be worth looking at despite today, especially if it only shifts down to a “neutral” instead of a “sell.” Investors looking for a metal company might want to check out Material Sciences Corp. (MSC 10/16/06).

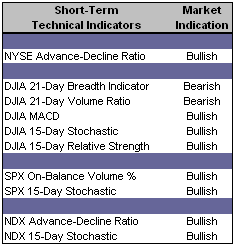

Investors looking for a metal company might want to check out Material Sciences Corp. (MSC 10/16/06).  Short-Term Technical Indicators – Breadth and Volume within the Dow Jones Industrial Average continue to support the bears, but as long as the market keeps gaining, no one is listening.

Short-Term Technical Indicators – Breadth and Volume within the Dow Jones Industrial Average continue to support the bears, but as long as the market keeps gaining, no one is listening. Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – Both the VIX, VXN and all three Put / Call ratios slipped lower again.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall investment portfolio.

Top Rated Major Market Derivative – Russell 2000 (IWM 10/9/06)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ 10/9/06)

Top Rated Sector Derivative – iShares Dow Jones Transportation (IYT 10/5/06)

Today’s Top “Buy” Recommended Stocks

- OM Group Inc. (OMG 8/11/06)

- Allegheny Technologies Inc. (ATI 10/5/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Carpenter Technology Corp. (CRS 10/5/06)

- Manitowoc Co. Inc (MTW 8/10/06)

- Veritas DGC Inc. (VTS 7/28/06)

- Centene Corp. (CNC 10/20/06)

- Sears Holdings Corp. (SHLD 9/19/06)

- Gymboree Corp. (GYMB 9/28/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- Apollo Group Inc. (APOL 10/13/06)

- Legg Mason Inc. (LM 10/11/06)

- Express Scripts Inc. (ESRX 9/22/06)

- Universal Forest Products Inc. (UFPI 5/24/06)

- Career Education Corp. (CECO 10/18/06)

0 Comments:

Post a Comment

<< Home