"All About Alpha"

Nevertheless, Chris does an incredible job of gathering and dissecting articles from all over the world on alpha-centric investing. But even more impressive is that he’s an excellent writer with the ability to inject humor into fairly complicated material. His site is a must for any investor interested in alpha, beta, or anything related to the two.

He labels my blog as one that “provides practical portable alpha implementation tips for individual investors.” I appreciate this designation because that’s the whole point of Alpha Advisor Service, LLC and Portable Alpha Daily. We help both private and professional investors adopt a portable alpha investment strategy using tools that the majority of the investment community is comfortable with.

Not all investors understand how to use futures and swaps for alpha or beta, or how to adjust allocation and exposure through leverage. And to be honest with you, I’m not convinced that such instruments are the best tools, which is what most hedge funds believe. I think that ETF’s and funds do the job just as well, are less risky and easier to use.

On another note, I’ve added a new category below titled “Today’s Top Sell Recommended Stocks.” Shorting is a popular method of generating alpha among traders and hedge funds and we include a “Short-Sell” category in our newsletter, but it’s not something we practice ourselves, preferring to use inverse mutual funds or ETF’s. However, the analytic we use to determine which securities are generating alpha on the long side can also be used, with some modification, to find securities that might generate alpha through “short-selling.”

I’m also exploring the idea of adding the dates that the security became a recommended “buy” or “sell” to the post. A fairly powerful picture can be painted by pulling up a chart of the security and looking at when our alpha analytic signaled a “buy” or “sell” recommendation.

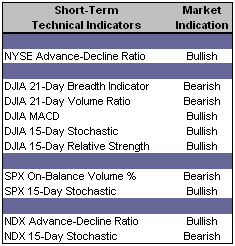

Short-Term Technical Indicators – Even though the markets continue to go up, our indicators are beginning to turn. I would not be surprised to see a consolidation; in fact I think we need it.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – Too complacent and too bullish. VIX and VXN are still very low, and all three Put / Call ratios slipped yesterday.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall investment portfolio.

Top Rated Major Market Derivative – Russell 2000 (IWM 10/9/06)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ 10/9/06)

Top Rated Sector Derivative – iShares NASDAQ Biotechnology (IBB 10/6/06)

Today’s Top “Buy” Recommended Stocks

- Allegheny Technologies Inc. (ATI 10/5/06)

- CPI Corp. (CPY 4/19/06)

- RTI International Metals Inc. (RTI 10/11/06)

- JLG Industries Inc. (JLG 9/26/06)

- Gymboree Corp. (GYMB 9/28/06)

- Legg Mason Inc. (LM 10/11/06)

- Apollo Group Inc. (APOL 10/13/06)

- LCA-Vision Inc. (LCAV 6/7/06)

- Advanced Micro Devices Inc. (AMD 9/27/06)

- Express Scripts Inc. (ESRX 9/21/06)

2 Comments:

Justin,

You're the man; and our inspiration here at All About Alpha. Alpha Male tips his hat.

BTW, we're working on a post comparing the ACC to the hedge fund industry - both prolific alpha producers. ;)

Alpha Male

By Anonymous, at 8:50 PM

Anonymous, at 8:50 PM

Comparing the ACC to the hedge fund industry...brilliant! If the ACC is the alpha, I guess that makes the Big East or the Big Ten the beta right?

By Justin, at 9:36 PM

Justin, at 9:36 PM

Post a Comment

<< Home