The three day sell-off of last week is the result of a rapid rise in interest rates which accelerated as the 10-year Treasury bond touched 5.25%. Generally rising interest rates are a negative for the stock market, which is attested to by the recent deterioration in the technical condition of the market. In our opinion, the most negative aspect of the sell-off was its broad base with the largest declines being experienced by the broader market indexes rather than the DJIA itself. This deterioration is reflected in the sharp decline in the number of AAS Buy Rated Markets, Sectors and Style boxes. Noteworthy, however, is that while the absolute number of AAS Buy Rated securities dropped to a low this past week, it is no where near the lows of March 2007 or October 2005.

Our AAS Sentiment analysis remains bullish, plus the independent sources which we follow continue to report that there remains a significant amount or liquidity on the side lines. This typically indicates that investors have yet to become fully invested in the stock market which historically happens just before a major top is formed.

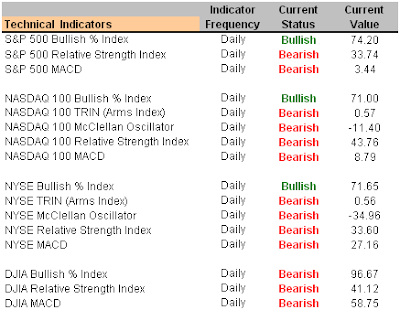

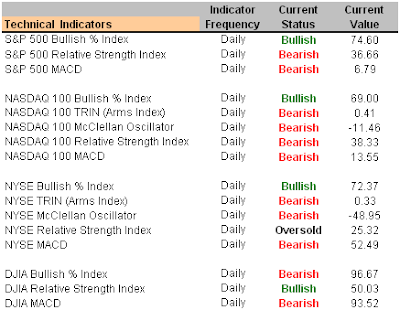

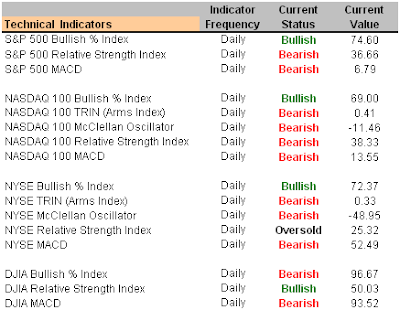

Our view of the market momentum is that it has deteriorated significantly this week as the advance/decline lines for both the NYSE and the NASDAQ suffered significant declines. The decline in the various utilities indices is worrisome as they may be breaking a four-year bull market. All of the other technical indicators which we follow show no real improvement in the overall short-term technical condition of the three major indexes despite Friday’s rally. We continue to advise our subscribers to remain cautious.

The market internals were positive Friday; quite the opposite for the prior three days. Although this rebound did not make up all the weakness of prior days, it may encourage the Bulls to again buy into the hopes of a further bounce up.

The AAS Market Model turned Bearish as of the close Tuesday, May 15, 2007. The total universe of stocks, ETF’s and mutual funds which we review on a daily basis is 1828. Of those reviewed, 426 are rated "Buy," 793 are rated "Sell" and 609 "Neutral”. We have lowered our recommended allocation in the Model Fund and Stock Portfolios to 25% invested and 75% in cash.

Looking into next week, the equity markets should be led by the bond markets. With few economic reports due, the May PPI and CPI numbers scheduled to be released on Thursday will likely give investors an indication of the impact rising rates will have for the stock market. Expectations are for a rise in both core PPI and core CPI numbers. Should these releases exceed expectations, they would be Bearish for stocks, while low numbers would have a Bullish implication.

Our Top-Down approach shows only the NASDAQ 100 as an AAS Buy Rated major market at this time. Those interested might look at either the NASDAQ 100 Trust Shares (QQQQ) or Fidelity NASDAQ Composite (ONEQ) as investable alternatives. Further analysis points out that the Mid Cap Core and Growth styles are currently rated an AAS Buy along with the Small Cap Core style. Alternatives here can be found with iShares Morningstar Mid Core (JKG), iShares Morningstar Small Growth (JKK) and iShares Morningstar Small Core (JKJ).

Moving on we look at the various sectors which are currently rated AAS Buy. The leader this week is Energy both with domestically and globally. Here we see opportunities with: Bristow Group Inc (BRS), Hornbeck Offshore Svcs Inc. (HOS), USX Marathon Group (MRO), National Oilwell Varco Inc (NOV) and Forest Oil Corp (FST). ETF’s and Funds that work within the Energy Sector would include: Energy Select Sector SPDR (XLE), iShares DJ U.S. Energy (IYE), iShares S&P Global Energy (IXC), Fidelity Select Energy Service (FSESX), Fidelity Select Energy (FSENX), ProFund Ultra Sector Oil & Gas (ENPIX) or Rydex Energy (RYEIX).

The next AAS Buy rated sector is Global Telecom. Opportunities here may be found with: Cincinnati Bell Inc. (CBB), Sprint Nextel (S), Qwest Communication International (Q), Verizon (VZ) and AllTel Corp (AT). ETF’s and Funds that work within the Telecom. Sectors are: iShares S&P Global Telecom (IXP), Vanguard Telecom Services (VOX), iShares S&P Global Telecom. (IXP), ProFund Ultra Sector Telecom. (TCPIX) or Rydex Telecom. (RYMIX).

Basic Materials is the third strongest AAS Buy Rated sector. Here we list the following stocks that currently carry an AAS Buy rating: Cleveland Cliffs Inc (CLF), Castle A M & Co (CAS), Lyondell Chemical Co (LYO), Olin Corp (OLN) or Lubrizol Corp (LZ). ETF’s and Funds that work within the Basic Materials Sector include: Materials SPDR (XLB), Vanguard Materials (VAW), ProFund Ultra Sector Basic Materials (BMPIX) and Rydex Basic Materials (RYBIX).

Technology is the fourth sector this week. Here opportunities can be found with: MIVA Inc (MIVA), Novatel Wireless Inc (NVTL), Cree Research Inc (CREE) and Apple Computers Inc (AAPL). ETF’s and Funds that work within the Technology Sector would include Morgan Stanley Technology (MTK), iShares Goldman Sachs Technology (IGM), Fidelity Select Computers (FDCPX), Fidelity Select Software & Computer (FSCSX), ProFund Ultra Sector Technology (TEPIX) and Rydex Technology (RYTIX).

Industrials are the fifth and last AAS Rated Buy Sector this week. Here we find Barnes Group Inc (B), Cubic Corp (CUB), Vicor Corp (VICR), Shaw Group Inc (SGR) and KBR INC (KBR) at the top of the list. ETF’s and Funds that work within the Industrial Sector include iShares Dow Jones U.S. Industrial (IYJ), Vanguard Industrials (VIS), Fidelity Select Natural Resources (FNARX), Fidelity Select Paper & Forest Prod (FSPFX), ProFund Ultra Sector Industrials (IDPIX).

Additional information on our firm may be found by clicking the following link, Alpha Advisor Service, LLC. Information concerning the availability of our newsletter is available by clicking AAS Information. Questions may be submitted to info@Alpha-Advisor.com.

Short-Term Technical Indicators

Investor Sentiment

Long-Term Market Model – Bearish since May 15, 2007

Asset Allocation Recommendation – AAS Model Portfolios are allocated at 75% cash and 25% long.

Top Alpha Generating Securities

Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top AAS Rated Major Market – Nasdaq 100 Trust Shares (QQQQ 5/31/07)

Top AAS Rated Style-Box for Alpha – iShares Morningstar Mid Cap Core (JKG 5/30/07)

Top AAS Rated Sector for Alpha – iShares Dow Jones U.S. Energy (IYE 3/19/07)

Top AAS Rated Long Stocks for Alpha

Crocs, Inc. (CROX 5/9/07)

Amazon.com, Inc. (AMZN 3/21/07)

Apple Inc. (AAPL 4/24/07)

Deckers Outdoor Corp. (DECK 9/7/06)

Cleveland-Cliffs Inc. (CLF 11/17/06)

Google Inc. (GOOG 5/29/07)

ITT Educational Service Inc. (ESI 2/8/07)

LandAmerica Financial Group Inc. (LFG 2/8/07)

Marathon Oil Corp. (MRO 3/14/07)

Nash-Finch Co. (NAFC 2/21/07)

Top AAS Rated Short Stocks for Alpha

Rogers Corp. (ROG 12/6/06)

Whole Foods Market Inc. (WFMI 5/2/07)

Volt Information Sciences (VOL 3/26/07)

Simon Property Group (SPG 5/1/07)

Regeneron Pharmaceuticals (REGN 5/17/07)

Review of Last Week’s Top AAS Rated Stocks

(Precursor to 130/30 Portfolio in Development)

highlighted securities are additions from last week's portfolio