Monday Morning Links:

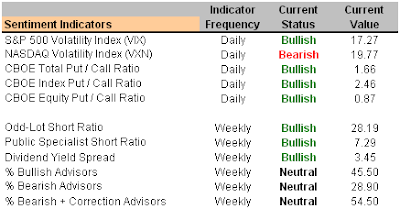

Dr. Brett on the bearish equity-put call ratio. (Our analysis has that ratio pegged as bullish, which illustrates the conundrum many technical investors are facing at the moment)

Abnormal Returns with links on the Blackstone IPO.

Alpha Male reports on hedge fund of funds.

Daily Options Report on March Expiration Madness.

The Curse of the Fat-Fingered Trader from FT Alphaville via Barry Ritholtz.

Great post from Hedge Fund blog on the 2 and 20 fee structure.

Millionaire Now! on the lag in mining stocks.

The U.S. markets slid last week on concerns of broad-market contagion linked to an increased level of mortgage defaults. Also, several economic reports illustrated that inflation remains a concern, which further reduces the likelihood of a Fed interest-rate cut in the near future.

Both the Financial and Retail sectors were down on speculation that rising foreclosures will slow home sales and restrain retail spending. Prices increased more than economists expected last month, as seen in the PPI and CPI repots.

The S&P 500 fell 15.90, or 1.1 percent, to 1386.95, wiping out the prior week's recovery and slipping to its level from the week ended March 2, when it dropped 4.4 percent. The Dow Jones Industrial Average sank 165.91, or 1.4 percent, to 12,110.41 while the NASDAQ Composite Index declined 14.89, or 0.6 percent, to 2372.66. Decliners outnumbered gainers on the NYSE by about five to three.

Our long-term market model remains bearish as of December 8th. The total universe of stocks, ETF’s and mutual funds which we review on a daily basis is 1859. Of those reviewed, 276 are rated "Buy," 743 are rated "Sell" and 840 "Neutral.” We reduced our model portfolio allocations this past week and are currently recommending an allocation of 75% in cash or money market investments and 25% mixed between long and inverse funds. The model stock portfolio remains roughly 27% long with 73% cash.

The traditional technical measurements of market health match up closely to those in place last year between mid-May and late-July. The only bullish technical indicators we observe are the Bullish % Indexes for the S&P 500, NASDAQ and NYSE. All the other technical indicators, with the exception of the NYSE TRIN, are Bearish as of Friday’s close.

However, we’re seeing mixed readings with regard to the sentiment indicators we employ in our analysis. The volatility experienced over the last two weeks has brought VIX up to levels that we define as Bullish. Overall, on a technical basis the market appears to be in line with what can be expected following a modest correction.

As in the prior two or three weeks, we continue to see opportunities for alpha within the Utilities (IDU), Telecom (IXP and IYZ), Broadband (BDH) and Basic Materials (IYM).

The Utility sector is our top rated, currently holding a “Buy” recommendation with an AAS Rating Score of 26.93. Those interested in Utilities for alpha might look at the following ETF and mutual funds: Utilities HOLDRS (UTH), iShares DJ US Utilities (IDU), Vanguard Utilities (VPU), Fidelity Select Utilities Growth (FSUTX), Utilities Spider (XLU), ProFund Ultra Sector Utilities (UTPIX), Rydex Utilities (RYUIX). On an equity basis, Entergy Corp (ETR), Questar Corp (STR), Constellation Energy Group (CEG) or Public Service Enterprise Group (PEG) are generating alpha.

Basic Materials alternatives include: Profund Ultra Sector Basic Materials (BMPIX), Rydex Basic Materials (RYBIX), iShares DJ US Basic Materials (IYM), Vanguard Materials (VAW) and Materials SPDR (XLB). Allegheny Technologies (ATI), Ryerson Inc. (RYI), Rock-Tenn Co. (RKT), Chaporral Steel (CHAP), Cleveland Cliffs Inc. (CLF), Temple Inland, Inc. (TIN) and Steel Dynamics Inc. (STLD) are also solid.

Within the Telecomm / Broadband grouping look at Fidelity Select Comm. Eqp. (FSDCX), ProFund Ultra Sector Telecom (TCPIX), Rydex Telecommunications (RYMIX), Belden CDT Inc. (BDC), MEMC Electrical Material (WFR), Avnet Inc. (AVT), Fei Co. (FEIC), Commscope Inc. (CTV), Qualcomm Inc. (QCOM), Anixter International Inc. (AXE), Harmonic Lightwaves, (HLIT) and Quanta SVCS, Inc. (PWR).

Short-Term Technical Indicators

Investor Sentiment

Long-Term Market Model – Bearish since December 8th.

Asset Allocation – AAS Model Portfolios have 75% cash allocations and mixed long – short allocations.

Top Alpha Generating Securities

Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Major Market ETF – No buy recommended major market investments

Top Style-Box ETF for Alpha – No buy recommended style-box investments

Top Sector ETF for Alpha – iShares Dow Jones U.S. Utilities (IDU 3/12/07)

Top Long Stocks for Alpha

Precision Castparts Corp. (PCP 9/20/06)

Allegheny Technology Inc. (ATI 10/5/06)

Deckers Outdoor Corp. (DECK 9/7/06)

Blue Coat Systems Inc. (BCSI 3/1/07)

WebEx Communications Inc. (WEBX 2/13/07)

Belden CDT Inc. (BDC 1/19/07)

Chemed Corp. (CHE 3/8/07)

Constellation Energy Group Inc. (CEG 11/24/06)

Ryerson Inc. (RYI 12/7/06)

Rock-Tenn Co. (RKT 4/27/06)

Top Short Stocks for Alpha

Beazer Homes USA Inc. (BZH 1/25/07)

Meritage Homes Corp. (MTH 12/18/06)

Spectrum Brands Inc. (SPC 2/8/07)

Shuffle Master Inc. (SHFL 12/11/06)

The Ryland Group Inc. (RYL 2/20/07)

Labels: Market Summary