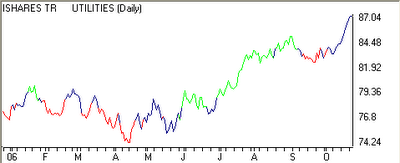

Utilities to the Rescue

Is it too late to allocate into the Utilities sector? I don’t think so, although I'd wait for IDU to get a "buy" recommendation (it's still a "neutral," which is why the line above is blue currently). Considering the weather is just beginning to turn cold and natural gas recently crossed over its 200-Day MA, finding one or two Utilities companies might be a good idea.

Is it too late to allocate into the Utilities sector? I don’t think so, although I'd wait for IDU to get a "buy" recommendation (it's still a "neutral," which is why the line above is blue currently). Considering the weather is just beginning to turn cold and natural gas recently crossed over its 200-Day MA, finding one or two Utilities companies might be a good idea. In fact, of the 87 Utilities securities that we analyze for alpha, an over-whelming majority have “neutral” recommendations and positive AAS Rating Scores. This means there is potential for many of these companies to be upgraded to “buy” recommendations if the trend continues.

In fact, of the 87 Utilities securities that we analyze for alpha, an over-whelming majority have “neutral” recommendations and positive AAS Rating Scores. This means there is potential for many of these companies to be upgraded to “buy” recommendations if the trend continues. Our two top-rated, “buy” recommended utility companies this morning are Northwest Natural Gas Co. (NWN, 8/28/06) and Nisource Inc. (NI 10/23/06).

Both have performed well over the last few weeks, but I’m not too sure how much further they can go. If you’re looking for Utility companies that are just beginning to trend and generate alpha, consider these for your watchlist: Southwestern Energy Co. (SWN), Equitable Resources Inc. (EQT) and Peoples Energy Corp. (PGL).

Both have performed well over the last few weeks, but I’m not too sure how much further they can go. If you’re looking for Utility companies that are just beginning to trend and generate alpha, consider these for your watchlist: Southwestern Energy Co. (SWN), Equitable Resources Inc. (EQT) and Peoples Energy Corp. (PGL). By the way, I’ve updated the Alpha Advisor Service, LLC archived newsletter to October 9, 2006. The link is in the right margin.

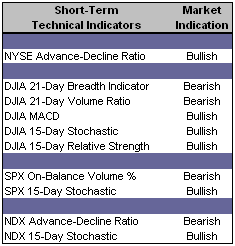

Short-Term Technical Indicators – Breadth and Volume within the Dow Jones Industrial Average continue to support the bears.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – There was a substantial jump in the Index Put / Call ratio yesterday, but both volatility indexes slipped slightly. Bullish sentiment continues to creep higher as the rally continues.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall investment portfolio.

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ 10/9/06)

Top Rated Sector Derivative – iShares Dow Jones U.S. Real Estate (IYR 6/30/06)

Today’s Top “Buy” Recommended Stocks

- OM Group Inc. (OMG 8/11/06)

- Allegheny Technologies Inc. (ATI 10/5/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Sears Holdings Corp. (SHLD 9/19/06)

- Carpenter Technology Corp. (CRS 10/5/06)

- Veritas DGC Inc. (VTS 7/28/06)

- Gymboree Corp. (GYMB 9/28/06)

- Steel Dynamics Inc. (STLD 10/19/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- JLG Industries Inc. (JLG 9/26/06)

- Apollo Group Inc. (APOL 10/13/06)

- Legg Mason Inc. (LM 10/11/06)

- Advanced Micro Devices Inc. (AMD 9/27/06)

- Universal Forest Products Inc. (UFPI 5/24/06)

- SanDisk Corp. (SNDK 10/20/06)

0 Comments:

Post a Comment

<< Home