The recent winning direction of the Dow Jones Industrial Average turned abruptly after starting the past week building on its longest daily win streak in four years. Triggering the turn about were comments by the Fed chairman on Wednesday, which once again raised doubts about future interest rate cuts and quickly put an end to the recent rally. With first-quarter earnings season now upon us, those companies reporting thus far are setting a tone for weaker than expected earnings, suggesting a difficult earnings front for 2007. As previously reported, corporate profits had been running rampant. Based upon the performance of the past several years investors have come to expect double-digit increases in year-over-year operating earnings. However, since the end of 2006 the momentum has been slowing and many are not forecasting a return to the double digit level until latter this year.

Over recent weeks we have identified an alpha generating opportunity with the Rydex Dynamic Weakening Dollar (RYWBX) fund. Lately, others are beginning to comment on the fact that the decline in the dollar was afflicting Treasury prices as U.S. currency has fallen 2.5 percent against the Euro in the past month.

Investors will get more data on inflation and the economy this week as the Commerce Department will report the CPI and Core CPI results for March, along with data on Retail Sales, Business Inventories, Housing Starts and Building Permits, Crude Oil Inventories, Industrial Production, Capacity Utilization, Initial Jobless Claims and Leading Economic Indicators. The markets turned into negative territory last week after the Reuters/University of Michigan preliminary consumer-sentiment index for April came in at 85.3, lower than expected. Additionally, the International Energy Agency report that world oil output fell in March.

Expect more volatility as the preliminary consensus is that the coming weeks reports will, in all likelihood, reflect continuing weakness in the U.S. Economy.

We remain modestly Bearish, in line with the posture of our long-term market model adopted on December 8, 2006. The total universe of stocks, ETF’s and mutual funds which we review on a daily basis is 1842. Of those reviewed, 349 are rated "Buy," 452 are rated "Sell" and 1041 "Neutral.” In the AAS Model Fund portfolios, we are currently recommending an allocation in the range of 50% cash or money market investments and 50% Long Funds or ETF’s. The Model Stock portfolio is slightly more aggressive with an allocation of 73% equities and 27% cash.

While still slightly Bearish we see strong alpha performances amongst a handful of ETF’s which track both the Mid and Small Cap markets segments. The iShares Morningstar Small Growth (JKK), iShares S&P Small Cap 600 (IJR), iShares Morningstar Mid Growth (JKH), iShares S&P Mid Cap 400 (IJH), iShares Russell 2000 (IWM) all outperformed the S&P 500 over the past week.

Joining this select grouping we might also look at picks from the Energy, Oil and Gas, Natural Resource or Utilities sectors coming from within the Mid Cap market segments. A list of these members from the Mid Cap universe should include Southwestern Energy Co (SWN), Denbury Resources Inc (DNR), Ashland Coal Inc (ACI), Quicksilver Resources Inc (KWK), Forest Oil Corp (FST), Grant Prideco Inc. (GRP), Tidewater Inc (TDW), Helmerich & Payne Inc.(HP), Cooper Cameron Corp (CAM) or Newfield Exploration Co (NFX).

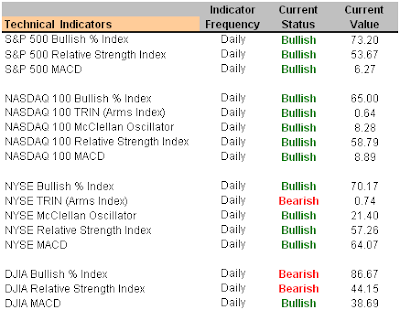

Short-Term Technical Indicators

Investor Sentiment

Long-Term Market Model – Bearish since December 8th.

Asset Allocation – AAS Model Portfolios are allocated at 50% cash and 50% long.

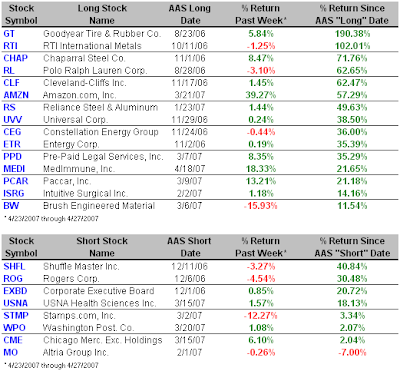

Top Alpha Generating Securities

Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Major Market ETF – iShares NYSE Composite (NYC)

Top Style-Box ETF for Alpha – iShares Morningstar Mid Cap Growth (JKH 3/20/07)

Top Sector ETF for Alpha – iShares Goldman Sachs Natural Resources (IGE 3/19/07)

Top Long Stocks for Alpha

Brush Engineered Material (BW 3/6/07)

RTI International Metals (RTI 10/11/06)

U.S. Steel Co. (X 2/28/07)

Chaparral Steel Co. (CHAP 11/1/06)

Cleveland-Cliffs Inc. (CLF 11/17/06)

Chemed Corp. (CHE 3/8/07)

Belden CDT Inc. (BDC 1/19/07)

Universal Corp. (UVV 11/29/06)

Entergy Corp. (ETR 11/2/06)

Novell, Inc. (NOV 3/7/07)

Top Short Stocks for Alpha

USNA Health Sciences Inc. (USNA 3/15/07)

Beazer Homes USA Inc. (BZH 1/25/07)

Meritage Homes Corp. (MTH 12/18/06)

Altria Group Inc. (MO 2/1/07)

Daktronics Inc. (DAKT 2/14/07)