Correction...Not Quite

Despite our market model being bearish, I feel allocating our portfolios in a 100% defensive posture is not prudent at the moment. I am recommending that the cash levels in the model fund portfolios be increased to 50%. I am also beginning to incorporate inverse funds in several portfolios, but only when those inverse funds carry "buy" recommendations.

With regard to the Model Stock Portfolio, we are not initiating any trades today and have decided to maintain our current allocation which is roughly 75% long and 25% cash. Our analytic is still rating those selected securities within the portfolio very high in terms of alpha generation and despite yesterday's losses, none of the issues triggered any "sell" recommendations. If the markets continue to weaken, we will recommend selling certain stocks and increasing the cash allocation.

Sell-offs and periods of correction are the most strident tests of investment discipline. Although our portfolios lost value yesterday, we maintain our confidence not only in the strategy employed but in our alpha analytic and market models. We will continue to select those funds that are generating the most alpha, we will not override our models on "speculation" or "theory" and we will not deviate from the strategy that has generated our historical out-performance.

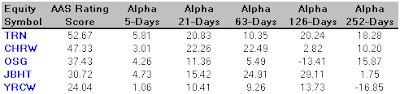

With that being said, it’s interesting to see how yesterday’s sell-off impacted our alpha analytic. Believe it or not, we did see several securities upgraded to buy status. The top eight are listed below:

Conversely, many more were downgraded to “sell” status with the bottom eight as follows:

My gut tells me that several months from now we’ll look back on yesterday’s session as the beginning phase of a defined market correction. I would feel much more comfortable shifting to a bullish stature in late-spring or early-summer if the market looses a bit more ground and the foundation for a bullish recovery is a more established. Until then I plan on hedging our portfolios either through cash or inverse fund allocations.

Short-Term Technical Indicators

Investor Sentiment

Long-Term Market Model – Bearish since December 8th.

Asset Allocation – AAS Model Portfolios have 50% cash allocations and mixed long – short allocations.

Beta Exposure and Portable Alpha Generation

Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Martin Marietta Materials, Inc. (MLM 11/6/06)

Vulcan Materials Co. (VMC 10/31/06)

Texas Industries Inc. (TXI 10/11/06)

Energizer Holdings Inc. (ENR 1/26/07)

TXU Corp. (TXU 2/23/07)

Weyerhaeuser Co. (WY 1/3/07)

Avnet Inc. (AVT 10/5/06)

Carbo Ceramics Inc. (CRR 2/27/07)

Temple-Inland, Inc. (TIN 12/5/06)

Itron Inc. (ITRI 1/19/07)

New Century Financial Corp. (NEW 6/13/06)

Google Inc. (GOOG 12/18/06)

Plexus Corp. (PLXS 12/29/06)

SanDisk Corp. (SNDK 10/20/06)

Labels: Market Summary