Telecom Re-Visited

In yesterday’s post I noted that there’s also alpha in more defensive sectors such as Real Estate (IYR 6/30/06), Consumer Services (IYC 9/8/06) and even Transports (IYT 10/5/06). The alpha generation of these sectors isn’t a new development and we’ve had “buy” recommendations on two of them for quite awhile. I think it's important for portable alpha investors not to get sucked into the hot market segments and forget the others, which is the impetus of yesterday's post. The markets have to be in dire straights not to have alpha somewhere and investors that have a myopic view and refuse to look outside the box are doing themselves a great disservice.

Of the seven “buy” recommended sector derivatives we have this morning, three are defensive and four are tech related including: Biotechnology (IBB 10/6/06), Software (IGV 8/10/06), Technology (IYW 8/15/06) and Telecommunication (IYZ 7/24/06). Although Telecom is one of our lowest rated “buy” recommended sector derivatives, it’s had a solid week of performance and continues to provide several alpha producing securities.

Of the thirty-three telecom stocks analyzed this morning, eight are “buy” recommended and fourteen are “neutral” recommended. An interesting company to put on the watch-list is Comtech Telecommunications Corp. (CMTL 9/22/06).

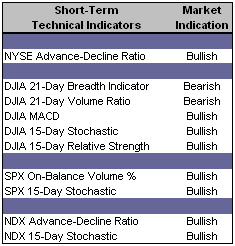

Short-Term Technical Indicators – Yesterday’s session certainly made an impact on our short-term technical indicators with all but two now bullish. The markets are beginning to (and perhaps have been) defy convention, which makes short-term indicators such as the ones below less effective. I don’t use these to dictate my bullish or bearish sentiment, but rather as an attempt to keep track of the market and minimize any surprises. With that being said…the markets are still surprising me.

Short-Term Technical Indicators – Yesterday’s session certainly made an impact on our short-term technical indicators with all but two now bullish. The markets are beginning to (and perhaps have been) defy convention, which makes short-term indicators such as the ones below less effective. I don’t use these to dictate my bullish or bearish sentiment, but rather as an attempt to keep track of the market and minimize any surprises. With that being said…the markets are still surprising me. Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – A modest jump in the VIX and VXN yesterday is welcome news to technical investors skeptical of a rally with volatility levels so low.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall investment portfolio.

Top Rated Major Market Derivative – Fidelity NASDAQ Composite Index Tracking (ONEQ 8/30/06)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ 10/9/06)

Top Rated Sector Derivative – iShares Dow Jones U.S. Real Estate (IYR 6/30/06)

Today’s Top “Buy” Recommended Stocks

- OM Group Inc. (OMG 8/11/06)

- Allegheny Technologies Inc. (ATI 10/5/06)

- CPI Corp. (CPY 4/19/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Sears Holdings Corp. (SHLD 9/19/06)

- JLG Industries Inc. (JLG 9/26/06)

- Gymboree Corp. (GYMB 9/28/06)

- Connectics Corp. (CNCT 10/10/06)

- Veritas DGC Inc. (VTS 7/28/06)

- World Acceptance Corp. (WRLD 4/25/06)

- Legg Mason Inc. (LM 10/11/06)

- Apollo Group Inc. (APOL 10/13/06)

- SanDisk Corp. (SNDK 10/20/06)

- Advanced Micro Devices Inc. (AMD 9/27/06)

- LCA-Vision Inc. (LCAV 6/7/06)

0 Comments:

Post a Comment

<< Home