Be Cautious with Some Tech Sectors

- Our Long-Term Market Model appears to have peaked on 9/21/06 and has weakened steadily since 10/16/06.

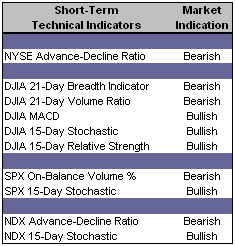

- The Short-Term Technical Indicators continue to scream “overbought.”

- Roughly 1/3 of the securities we analyze daily carry “buy” recommendations.

We do have several “sell” recommended sectors though including Software (IGV 10/27/06), Networking (IGN 10/18/06) and Semiconductors (IGW 10/18/06). Goldman Sachs released a very interesting report on motherboard demand, which supports our “sell” recommendations on the above sectors. The real question is whether computer sales will pick up going into the holiday season.

We’re very cautious at the moment and will likely be so at least throughout the week. Even though we’re still bulls with a 100% long allocation, we’re paying very close attention to our sell-limit values. Stock selection for alpha is growing increasingly more difficult.

Short-Term Technical Indicators – Modest weakness in all four indexes as a result of Friday’s sell-off.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – Both the VIX and VXN as well as all three Put / Call ratios edged higher on Friday. All five indicators have values higher than the week prior, but are still historically very low.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall investment portfolio.

Date = Date of AAS “Buy” Recommendation

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ 10/9/06)

Top Rated Sector Derivative – iShares Dow Jones Real Estate (IYR 6/30/06)

Today’s Top “Buy” Recommended Stocks

- OM Group Inc. (OMG 8/11/06)

- Allegheny Technologies Inc. (ATI 10/5/06)

- Harman International Industries Inc. (HAR 10/9/06)

- Centene Corp. (CNC 10/20/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Sears Holdings Corp. (SHLD 9/19/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- Gymboree Corp. (GYMB 9/28/06)

- Piper Jaffray Companies (PJC 10/4/2006)

- Veritas DGC Inc. (VTS 7/28/06)

0 Comments:

Post a Comment

<< Home