Wednesday saw significant gains in U.S. stocks, with the Dow Jones Industrial Average closing at a new record high and the S&P 500 breaching the 1440 resistance level for the first time in over six years. Again the driving force behind the rally was solid reports from tech stalwarts Yahoo Inc. (YHOO) and Sun Microsystems Inc. (SUNW) among others, as well a modest gain in crude supporting energy stocks. The Dow Jones Industrial Average added 87.97 points, or 0.70 percent, to close at 12,621.77. The S&P 500 Index improved by 12.14 points, or 0.85 percent, to finish the session at 1,440.13 while the NASDAQ Composite Index gained 34.87 points, or 1.43 percent, to end the day at 2,466.28.

Trading volume was mixed though, with below-average activity on the NYSE compared to elevated volume on the NASDAQ. 1.59 billion shares were traded on the Big Board, with advancing issues outnumbering declining ones by about 7 to 3. The NASDAQ saw 2.26 billion shares traded with an advance-decline ratio of 2 to 1.

The Treasury market ended the session on Wednesday with little change in bond prices. The benchmark 10-year Treasury note ended flat at 98 17/32, with a yield of 4.813%. The 30-year bond closed with a yield of 4.911% while the 2-year note ended up 2/32, yielding 4.928%.

Serving as a catalyst today in the bond market is a report on December’s existing U.S. home sales. Economists polled are expecting a decline in sales to 6.24 million from 6.28 million in November. Investors will then have to digest reports on Friday covering new-home sales and durable-goods orders for December.

Global markets also enjoyed a substantial rally on Wednesday aided by a boost in commodity stocks. Britain's FTSE 100 Index ended up 1.4 percent at 6,314.8. Asia saw the Nikkei 225 Index gain 0.57 percent to close at 17,507.40, its highest since April 7. The broader TOPIX Index was up 0.45 percent at 1,738.61. Asian indexes took some profits today, with the Nikkei 225 Index closing down 49.10 points to 17,458.30 but the FTSE 100 Index is marching on with a gain of 0.27 percent by 6:30 am EST.

Another influential data point yesterday was the U.S. crude oil inventory report. Deliveries from refineries and terminals averaged 20.4 million barrels a day last week, no doubt the result of a rash of cold weather invading the northeastern part of the country. U.S. crude gained 33 cents, or 0.6 percent, to settle at $55.37 a barrel while London Brent Crude settled at $55.43. U.S. supplies of distillates grew by 700,000 barrels in the week ended January 19, contrary to analyst forecasts of a drop of about 800,000 barrels.

Precious metals reversed course mid-day with Gold reaching a seven-week high late in trading. Despite a stronger dollar, Wall Street is expecting the precious metal to breach an important resistance level of $650 an ounce in the coming days or weeks. February Gold delivery settled up $2.30 at $648.20 an ounce on the NYMEX. AAS Platinum Subscribers utilizing the Model ProFund Portfolio will unfortunately experience a short-term reversal with today’s “sell” recommendation of the ProFunds Short Precious Metals (SPPIX) fund. The fund was up nearly 9% YTD and obviously producing tremendous alpha when our analytic upgraded it to “buy” status on January 18th. However, precious metals have rallied of late, despite a strengthening dollar, and the analytic has reverted to a “sell” recommendation.

Our long-term market model remains bearish as of December 8th. The total universe of stocks, ETF and funds which we review on a daily basis is 1,889. Of those reviewed, 301 are rated "Buy," 509 are rated "Sell" and 1,079 "Neutral." Our model portfolios are currently allocated between 56.25% and 75% long.

Again, there are no “buy” recommended major market derivatives or style-box derivatives and Financial Services (IYG) and Financials (IYF) are the only “buy” recommended sectors. Obviously we continue to urge caution as the market seeks definition and direction over the next few trading days and weeks.

Short-Term Technical Indicators

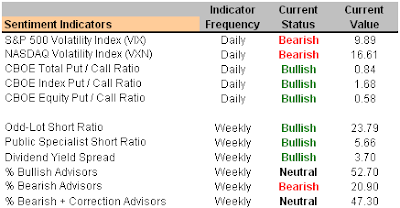

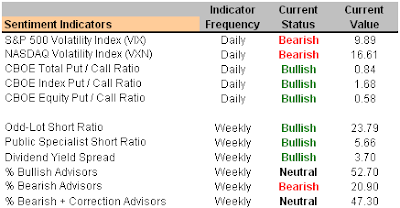

Investor Sentiment

Long-Term Market Model – Bearish since December 8th.

Asset Allocation – AAS Model Portfolios are between 56.25% and 75% long currently.

Beta Exposure and Portable Alpha Generation

Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – No buy recommended major market investments

Top Rated Style-Box Derivative – No buy recommended style-box investments

Top Rated Sector Derivative – iShares Dow Jones U.S. Financial (IYF 1/16/07)

Today’s Top “Buy” Recommended Stocks

NBTY, Inc. (NTY 12/5/06)

Savient Pharmaceuticals Inc. (SVNT 8/9/06)

CPI Corp. (CPY 1/23/07)

Precision Castparts Corp. (PCP 9/20/06)

CarMax Inc. (KMX 7/25/06)

Martin Marietta Materials, Inc. (MLM 11/6/06)

Navistar International Corp. (NAV 9/12/06)

The Goodyear Tire & Rubber Co. (GT 8/23/06)

The Ryland Group Inc. (RYL 1/18/07)

Brown Shoe Company Inc. (BWS 9/12/06)

Today’s Top “Sell” Recommended Stocks

Advanced Micro Devices Inc. (AMD 9/27/06)

StarTek, Inc. (SRT 11/28/06)

Whole Foods Market Inc. (WFMI 11/2/06)

Brightpoint Inc. (CELL 9/19/06)

Lenox Group Inc. (LNX 12/22/06)

Short-Term Technical Indicators

Short-Term Technical Indicators