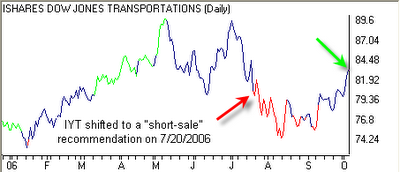

Alpha in Transports

What’s even more encouraging is that IYT was upgraded to a “buy” recommended derivative this morning. Not only was it upgraded, but it’s our fifth strongest rated sector out of the ten that are “buy” recommended. Financials, Real Estate and Technology continue to be strong sectors for us, but I think Transports warrant serious consideration.

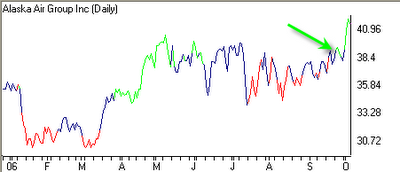

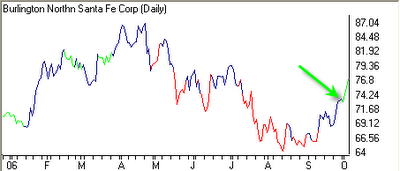

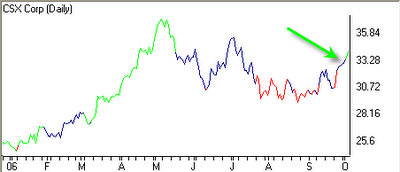

Three of our top rated transportation companies this morning are: Alaska Air Group Inc. (ALK), Burlington Northern Santa Fe Corp. (BNI) and CSX Corp (CSX).

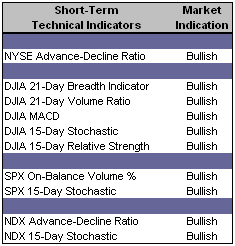

Short-Term Technical Indicators – Bullish across the board.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX as well as the Equity Put / Call ratio edged up slightly yesterday. There’s increasing sentiment that the markets are approaching overbought conditions, and therefore the institutional investors might be positioning themselves for the markets to move lower, at least with regard to equities. However, the Index Put / Call ratio moved lower yesterday and remains lower than last week’s value.

Asset Allocation – 75% to 85% invested within the actively-managed portion of the overall investment portfolio. 15% to 25% in cash or bonds.

Top Rated Major Market Derivative – Fidelity NASDAQ Composite Index (ONEQ)

Top Rated Style-Box Derivative – Morningstar Large Cap Core (JKD)

Top Rated Sector Derivative – iShares Goldman Sachs Software (IGV)

Today’s Top “Buy” Recommended Stocks

- OM Group Inc. (OMG)

- CPI Corp. (CPY)

- Gymboree Corp. (GYMB)

- World Acceptance Corp. (WRLD)

- Goldman Sachs Group Inc. (GS)

0 Comments:

Post a Comment

<< Home