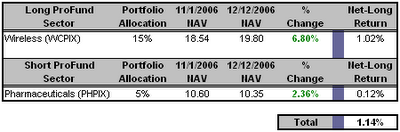

Long / Short Sector Strategies

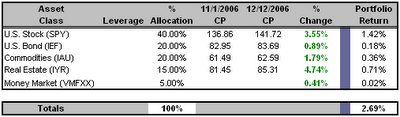

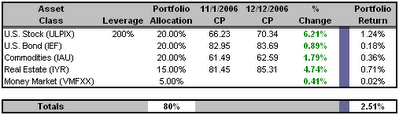

Applying leverage to the same portfolio through the use of the ProFund Ultra Bull (ULPIX) mutual fund would look like this:

Applying leverage to the same portfolio through the use of the ProFund Ultra Bull (ULPIX) mutual fund would look like this: Because the ProFunds Ultra Bull is levered 200% to the daily price movement of the S&P 500, a 20% allocation of ULPIX would provide the same exposure to the S&P 500 as a 40% allocation of SPY. Not only did this produce out-performance, but it released capital which could then be allocated into alpha generating investments.

Because the ProFunds Ultra Bull is levered 200% to the daily price movement of the S&P 500, a 20% allocation of ULPIX would provide the same exposure to the S&P 500 as a 40% allocation of SPY. Not only did this produce out-performance, but it released capital which could then be allocated into alpha generating investments.In this case, 20% of the portfolio could then be allocated into a Long / Short Sector strategy. Since the Long-Term Market Model was bullish the entire month of November, we would probably allocate 15% long and 5% short. Buying inverse ETF’s or inverse sector mutual funds is the best method for capitalizing on downward price movement in various sectors. Unfortunately, the data doesn’t exist to analyze yet, so I have to use PHPIX as a proxy and take the inverse of its performance. As such, a Long / Short Sector strategy might look something like this:

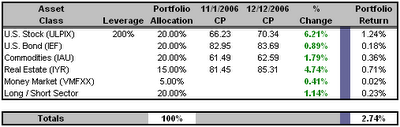

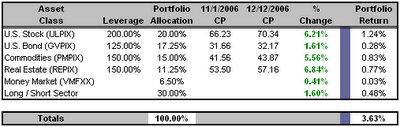

Overlaying the Long / Short Sector return onto the leveraged portfolio above would produce this:

Overlaying the Long / Short Sector return onto the leveraged portfolio above would produce this: That might not look like a lot, but that’s a 9% improvement over the un-levered portfolio. Compound that improvement annually and you can see the potential of portable alpha. Not only that, but if you utilize other leveraged mutual funds across the different asset classes, you could get a portfolio that allows for a 30% allocation into alpha generation:

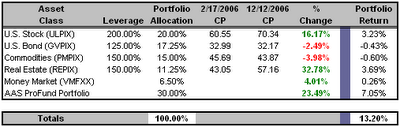

That might not look like a lot, but that’s a 9% improvement over the un-levered portfolio. Compound that improvement annually and you can see the potential of portable alpha. Not only that, but if you utilize other leveraged mutual funds across the different asset classes, you could get a portfolio that allows for a 30% allocation into alpha generation: That’s a nearly 35% improvement over the un-levered portfolio in just a few weeks. Obviously a portfolio like this has its drawbacks, notably the elevated volatility and risk when using leverage. So caution and oversight is strongly recommended. But each day more and more tools are becoming available that make utilizing a portable alpha strategy so compelling.

That’s a nearly 35% improvement over the un-levered portfolio in just a few weeks. Obviously a portfolio like this has its drawbacks, notably the elevated volatility and risk when using leverage. So caution and oversight is strongly recommended. But each day more and more tools are becoming available that make utilizing a portable alpha strategy so compelling.For those investors not comfortable with selecting the alpha generating investments, the five AAS Model portfolios can help. Since the first edition of our newsletter on February 17th 2006, the AAS Model ProFund portfolio is up over 23%. Overlay that performance onto a leveraged portfolio from February 17th and you get this:

With an S&P 500 return of 9.66% since then, this portable alpha approach using ProFunds outperforms the broad market index by 36.65%. As you can tell, we’re big fans of ProFunds and very excited to implement the current and future ProFunds and ProShares into our portfolios. The potential that these vehicles bring to the table are exceedingly impressive. For further information on ProFunds or ProShares I suggest contacting Mike Warren. We've dealt with Mike for several years now and have been very impressed with his knowledge and assistance.

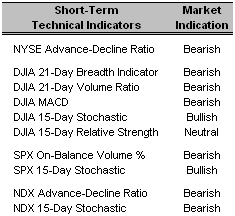

With an S&P 500 return of 9.66% since then, this portable alpha approach using ProFunds outperforms the broad market index by 36.65%. As you can tell, we’re big fans of ProFunds and very excited to implement the current and future ProFunds and ProShares into our portfolios. The potential that these vehicles bring to the table are exceedingly impressive. For further information on ProFunds or ProShares I suggest contacting Mike Warren. We've dealt with Mike for several years now and have been very impressed with his knowledge and assistance. Short-Term Technical Indicators – The 15-Day Stochastic indicators for all three indexes improved yesterday, but that’s the only positive development in our short-term technical indicators.

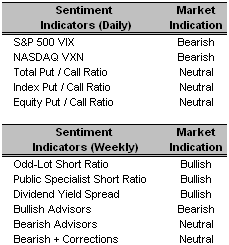

Long-Term Market Model – Bearish since December 8th.

Long-Term Market Model – Bearish since December 8th.Investor Sentiment – Yesterday saw a drop in VIX and VXN on the heels of a benign FOMC meeting. However, institutional investors are betting that the markets will move lower, as evident by increased put volume yesterday resulting in higher Put / Call ratios.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – NYSE 100 (NYC 11/6/06)

Top Rated Style-Box Derivative – iShares Morningstar Mid Cap Value (JKI 11/10/06)

Top Rated Sector Derivative – iShares Dow Jones Energy (IYE 11/10/06)

Today’s Top “Buy” Recommended Stocks

- RTI International Metals Inc. (RTI 10/11/06)

- Alleghany Technologies Inc. (ATI 10/5/06)

- Veritas DGC Inc. (VTS 7/28/06)

- Daktronics Inc. (DAKT 10/31/06)

- Robbins & Myers Inc. (RBN 8/10/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- Albemarle Corp. (ALB 8/9/06)

- Manitowoc Company Inc. (MTW 8/10/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Credence Systems Corp. (CMOS 11/6/06)

2 Comments:

Just bought some ProShares UltraShort Dow30 on Friday. Intel, Apple & IBM all beat analyst forecasts & smart money sold the news. I think this may signal the top of the market. Add on the continued inverted yield curve, stagflation, housing slump, & a dwindling chance of a rate cut... and I think these low-cost hedging instruments are looking good for everyone's portfolio.

By Eric B, at 9:07 PM

Eric B, at 9:07 PM

ProFunds and ProShares are absolutely perfect hedging instruments. You're call on DXD makes sense to me as a hedge, but are you still long some dow components? Our analytic is still not producing "buy" recommendations on any inverse funds yet, but if you're right about the market top that should change sooner rather than later.

By Justin, at 5:57 AM

Justin, at 5:57 AM

Post a Comment

<< Home