Good Morning

Long-Term Market Model – Bearish since December 8th.

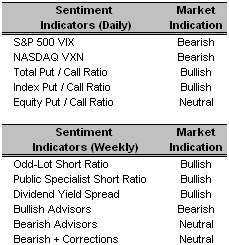

Long-Term Market Model – Bearish since December 8th.Investor Sentiment – All five of the daily sentiment indicators increased yesterday, lead by a 149% increase in the Index Put / Call Ratio, the biggest one-day change since October 24th. All three ratios and the VXN closed above their respective values one week ago.

Asset Allocation – 75% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Asset Allocation – 75% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – NYSE 100 (NYC 11/6/06)

Top Rated Style-Box Derivative – iShares Morningstar Large Cap Value (JKF 11/29/06)

Top Rated Sector Derivative – iShares Dow Jones Basic Materials (IYM 10/16/06)

Today’s Top “Buy” Recommended Stocks

- RTI International Metals Inc. (RTI 10/11/06)

- Veritas DGC Inc. (VTS 7/28/06)

- Daktronics Inc. (DAKT 10/31/06)

- Robbins & Myers Inc. (RBN 8/10/06)

- F5 Networks Inc. (FFIV 9/20/06)

- NBTY, Inc. (NTY 12/5/06)

- Albemarle Corp. (ALB 8/9/06)

- Joy Global Inc. (JOYG 11/13/06)

- Brown Shoe Company Inc. (BWS 9/12/06)

- The Ryland Group Inc. (RYL 11/14/06)

0 Comments:

Post a Comment

<< Home