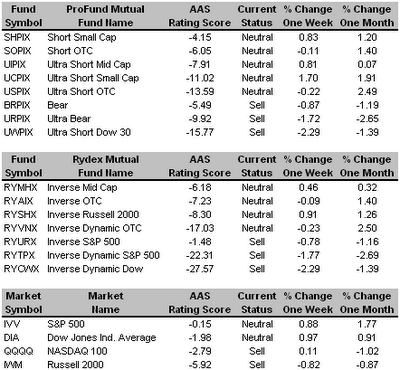

Inverse Funds

Each year, Mr. Zell build’s intricate voice boxes (I think that's what you call them), which is what the man with the umbrella is part of, and sends them to his friends and associates. One of our former associates was lucky enough to be on the receiving end of these gifts from Mr. Zell, so our office was full of them. It’s a pretty cool way of sharing thoughts, which coming from Mr. Zell are very insightful. Not only that, but it sounds like B.J. Thomas is actually singing the song.

With our long-term market model turning defensive almost two weeks ago, I’m paying close attention to investments that generate alpha in down-trending markets. For the record, the AAS Model portfolios are still long, but we’ve reduced the allocation in the fund portfolios to 75% long, 25% cash and in the stock portfolio we’re 70% long with 30% in cash.

We still don’t have any “buy” recommendations on our inverse mutual funds, but as you can see from the chart below, some are performing on par with the broad-markets, and others are beginning to generate alpha. Over the last week or so, several have been upgraded to “neutral” status. When and if we get “buy” recommendations on the inverse funds, we might shift some of the 25% cash allocation into them.

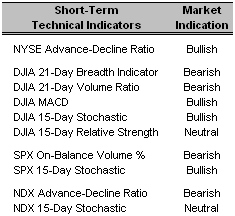

Short-Term Technical Indicators – Yesterday saw improvement in all the Dow Jones short-term technical indicators, with the exception of the Stochastic, which was unchanged. The S&P 500 and NASDAQ indicators didn’t fare too well however, with the On-Balance Volume % and both Stochastic indicators declining.

Short-Term Technical Indicators – Yesterday saw improvement in all the Dow Jones short-term technical indicators, with the exception of the Stochastic, which was unchanged. The S&P 500 and NASDAQ indicators didn’t fare too well however, with the On-Balance Volume % and both Stochastic indicators declining. Long-Term Market Model – Bearish since December 8th.

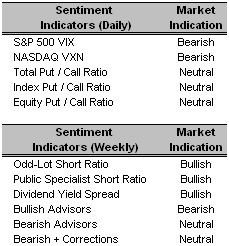

Long-Term Market Model – Bearish since December 8th.Investor Sentiment - VIX, Total and Index Put / Call Ratios lost ground while the VXN and Equity Put / Call Ratio increased.

Asset Allocation – 75% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Asset Allocation – 75% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – NYSE 100 (NYC 11/6/06)

Top Rated Style-Box Derivative – iShares Morningstar Large Cap Value (JKF 11/29/06)

Top Rated Sector Derivative – iShares Dow Jones Energy (IYE 11/10/06)

Today’s Top “Buy” Recommended Stocks

- RTI International Metals Inc. (RTI 10/11/06)

- Veritas DGC Inc. (VTS 7/28/06)

- Daktronics Inc. (DAKT 10/31/06)

- Robbins & Myers Inc. (RBN 8/10/06)

- Joy Global Inc. (JOYG 11/13/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- NBTY, Inc. (NTY 12/5/06)

- Albemarle Corp. (ALB 8/9/06)

- Brown Shoe Company Inc. (BWS 9/12/06)

0 Comments:

Post a Comment

<< Home