Alpha in Homebuilders?

There’s a lot of discussion about whether or not it’s time to invest in homebuilders, which is an issue I’m not yet comfortable with. I wouldn’t argue against a small speculative position, but I still think there are better opportunities for alpha generation in other sectors. But I can’t argue with the performance that most of the stocks have shown over the last few weeks. It’s an interesting development that I’ll certainly pay attention to over the next few days and weeks.

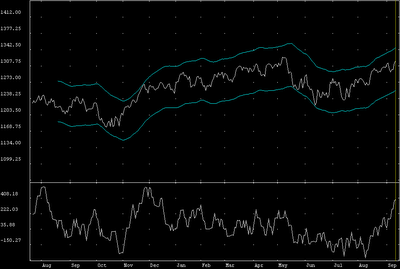

Short-Term Technical Indicators – There’s been a big jump over the last couple days in the S&P 500’s On-Balance Volume % indicator, which I use to support new highs in the market. Basically, if there’s a new high not supported by a new OBV high, I view that as short-term bearish. If the S&P 500 continues its bullish trend and closes higher than the 1325.76 established on May 5th, and the OBV continues to climb, I might adjust our asset allocation recommendation to be further invested sometime next week.

Long-Term Market Model – Bullish since August 23rd.

Investor Sentiment – Both of the volatility indexes and all three Put / Call ratios declined again overnight, now significantly lower than last weeks levels.

Asset Allocation – 75% to 85% invested within the actively-managed portion of the overall investment portfolio. 15% to 25% in cash or bonds.

Top Rated Major Market Derivative – Russell 2000 (IWM)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ)

Top Rated Sector Derivative – iShares Goldman Sachs Semiconductor (IGW)

Today’s Top “Buy” Recommended Stocks

- NVR Inc. (NVR)

- Veritas DGC Inc. (VTS)

- Piper Jaffray Companies (PJC)

- Sequa Corp. (SQA-A)

- Cooper Companies Inc. (COO)

0 Comments:

Post a Comment

<< Home