Alpha and the Week Ahead

Today’s Alpha Advisor Service, LLC newsletter is unusual in that there are so few buy-rated securities available for our subscribers. According to our analysis there are only 80 securities out of 1800+ which are currently buy-rated as compared to the daily average of 410 since we first began publishing the newsletter. We took this statistic one step further and found that market bottoms have occurred in the S&P 500 when the number of AAS buy-rated securities fell below 100. These market bottoms transpired in October 2005, in June 2006 and most recently in March 2007. While short-lived, these bottoms represented periods of significant asset class rotation followed by the resumption of the bullish trend.

We believe that the

Thus far the companies who have reported earnings have beaten expectations by a slightly lower margin than in the recent past. Out of the 304 companies of the S&P 500 that have reported, approximately 64% have beaten estimates as compared with an average of 68% over the past eight quarters.

Concerns over the collapse in the sub-prime mortgage sector and the related policy changes within the banks that have been providing debt funding to the LBO markets will continue to fuel the day to day volatility of the markets. Investors next week will remain on the lookout for more hedge fund troubles. News broke this past week that a second Australian hedge fund has run into trouble because of its exposure to

We recommend a defensive portfolio allocation in line with the recommendation of the AAS Market Model which turned Bearish as of the close Tuesday, May 15, 2007. The total universe of stocks, ETF’s and mutual funds which we review on a daily basis is 1802. Of those reviewed, 80 are rated "Buy," 1070 are rated "Sell" and 652 "Neutral”. We remain bearish, and our Model Fund and Stock Portfolios are allocated around 0% to 25% long and 75% to 100% defensive.

There are no AAS buy-rated Markets, Sectors or Styles this week. In fact, the only buy-rated security on our Market Overview page is the iShares Lehman 1-3 Year Bond (SHY). However, on the ProFund and Rydex mutual fund pages we see alpha generating securities in the inverse index and sector funds. Further analysis highlights alpha in the Bond, Commodity, International and Alternative Product sectors.

Despite last week’s troubles, there are still alpha-generating securities available. The list below comes from our Top Ten page of the newsletter and the securities listed are biased towards Medical, Energy and Inverse investment opportunities.

Equities: Sturm Ruger (RGR), Hanesbrands Inc (HBI), Cabot Microelectroics (CCMP), Lennox International (LII), DJ Orhtopedics Inc (DJO), Astec Inds Inc (ASTE), Smith A O Corp (AOS), Deckers Outdoor Corp (DECK), National Oilwell Varco Inc (NOV), Biogen IDEC (BIIB), Plantronics Inc (PLT), Cummins Inc (CMI), Gen-Probe Inc (GPRO), IDEXX Laboratories Inc. (IDXX), FMC Technologies Inc. (FTI), ITRON Inc. (ITRI), Sandisk Corp (SNDK), Anixter International Inc (AXE), Precision Castparts Corp (PCP), Schlumberger Ltd. (SLB), Mgi Pharma Inc (MOGN), Noble Drilling Corp (NE), Air Prods & Chems Inc (APD), Transocean Sedco Forex Inc (RIG) and Washington Post Co Clb (WPO).

ETF’s and Mutual Funds: ProFund Ultra Short Small Cap (UCPIX), ProFund Ultra Short Mid Cap (UIPIX), ProFund Short Real Estate (SRPIX), ProFund Ultra Bear (URPIX), Inverse S & P 500 Strategy (RYTPX), Inverse Russell 2000 Strategy (RYSHX), ProFund Short Small Cap (SHPIX), Inverse Dow 2x Strategy (RYCWX), ProFund Ultra Short Dow 30 (UWPIX), Inverse Mid Cap Strategy (RYMHX), Inverse OTC 2x Strategy (RYVNX), ProFund Ultra Short OTC (USPIX), Inverse S & P 500 2x Strategy (RYURX), ProFund Bear (BRPIX), ProFund Short Oil & Gas (SNPIX), Inverse OTC Strategy (RYAIX), ProFund Short OTC (SOPIX), iShares Lehman 1-3 Year Bond (SHY), Commodities Strategy (RYMBX), Strengthening Dollar 2x Strategy (RYSBX), iShares GSCI Commodity-Index Trust (GSG) and ProFund Rising U.S. Dollar (RDPIX).

A word of caution about most of the Inverse funds listed above. They are leveraged between 1.25x and 2x the underlying benchmark. These funds are capable of producing significant out-performance during the appropriate periods in a market cycle. However, the leverage does produce significant short term price volatility, as such the investor is advised to establish tight stop loss limits and to keep a keen eye on these securities at all times.

Additional information on our firm may be found by clicking the following link, Alpha Advisor Service, LLC. Information concerning the availability of our newsletter is available by clicking AAS Information. Questions may be submitted to info@Alpha-Advisor.com.

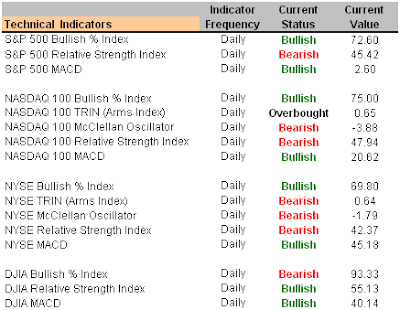

Short-Term Technical Indicators

Investor Sentiment

Long-Term Market Model – Bearish since May 15, 2007

Asset Allocation Recommendation – AAS Model Portfolios are allocated at 50 - 100% cash and 25 - 50% long.

Top Alpha Generating Securities

Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Deckers Outdoor Corp. (DECK 9/7/06)

National-Oilwell Varco Inc. (NOV 3/7/07)

Precision Castparts Corp. (PCP 9/20/06)

Cummins Inc. (CMI 1/31/07)

FMC Technologies Inc. (FTI 3/7/07)

Transocean Inc. (RIG 4/20/07)

Astec Industries (ASTE 7/18/07)

Schlumberger Ltd. (SLB 3/7/07)

Noble Corp. (NE 3/23/07)

Itron Inc. (ITRI 7/12/07)

Beazer Homes USA Inc. (BZH 1/25/07)

Sears Holding Corp. (SHLD 5/3/07)

Meritage Homes Corp. (MTH 12/18/06)

Sepracor Inc. (SEPR 5/17/07)

Vulcan Materials Co. (VMC 5/10/07)

Highlighted securities are additions from the prior week’s portfolio