Mid-Week Alpha

The Dow Jones Industrial Average rose 76.17 to 13577.87 on Wednesday putting it down about 0.25% for the first three days of the week and up 8.9% on the year. The S&P 500 added 8.64 to 1518.76, also down 0.68% thru mid week and up 7.1% year to date. The NASDAQ was up 12.63 to 2651.79, down 0.85% thus far and is 9.8% higher so far this year.

In the bond markets, the price of the 5–year note dropped slightly raising the yield to 4.979 percent, the 10– year note dropped 8/32nds, raising its yield to 5.09% and the 30–year bond declined 30/32nds to a yield of 5.191%.

On the New York Stock Exchange Wednesday, 1,803 stocks gained and 1,504 declined, on volume of 1.52 billion shares traded. Stocks making 52-week highs just barely out paced those making 52-week lows. Over at the NASDAQ, 2.06 billion shares traded on the exchange, with 1, 618 stocks up and 1,398 down for the session.

Dragging down equities is increased concern that the rating agencies will downgrade certain debt securities backed by sub-prime mortgages. Doing so would undoubtedly cause a massive sell-off of such securities, in turn devastating hedge fund portfolio returns and bringing to light more fund collapses. We’re also seeing “risk” beginning to get re-priced in the credit markets, causing spreads to widen and volatility to escalate. Also weighing on the markets were the inflationary comments made by Federal Reserve Chairman Ben Bernanke on Tuesday.

However, the negative news around sub-prime lending has not yet translated into lower investor sentiment which continues to help the equity market. Even though there are potential hazards in the market, we feel that alpha is still plentiful and available for the research oriented investor.

We continue to recommend a conservative portfolio allocation in line with the recommendation of the AAS Market Model which turned Bearish as of the close Tuesday, May 15, 2007. The total universe of stocks, ETF’s and mutual funds which we review on a daily basis is 1811. Of those reviewed, 267 are rated "Buy," 712 are rated "Sell" and 827 "Neutral”. While we remain conservatively bearish, our Model Fund and Stock Portfolios are allocated around 50-75% invested and 0-25% in cash

Additional information on our firm may be found by clicking the following link, Alpha Advisor Service, LLC. Information concerning the availability of our newsletter is available by clicking AAS Information. Questions may be submitted to info@Alpha-Advisor.com

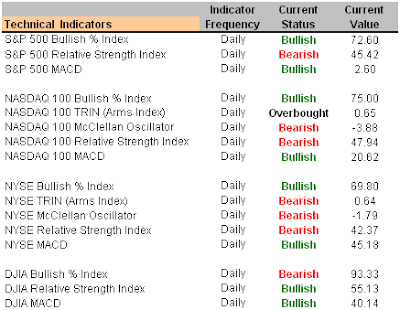

Short-Term Technical Indicators

Investor Sentiment

Long-Term Market Model – Bearish since May 15, 2007

Asset Allocation Recommendation – AAS Model Portfolios are allocated between 63-75% cash and 38-50% long.

Top Alpha Generating Securities

Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Crocs Inc. (CROX 5/9/07)

Apple Inc. (AAPL 4/24/07)

Precision Castparts Corp. (PCP 9/20/06)

Deckers Outdoor Corp. (DECK 9/7/06)

Google, Inc. (GOOG 5/29/07)

National-Oilwell Varco Inc. (NOV 3/7/07)

Blue Coat Systems Inc. (BCSI 3/1/07)

ITT Educational Services Inc. (ESI 2/8/07)

Freeport-McMoRan Cooper & Gold Inc. (FCX 3/8/07)

Robbins & Myers Inc. (RBN 6/12/07)

Sears Holding Corp. (SHLD 5/3/07)

Beazer Homes USA Inc. (BZH 1/25/07)

Rogers Corp. (ROG 12/6/06)

Simon Property Group Inc. (SPG 5/1/07)

Meritage Homes Corp. (MTH 12/18/06)

0 Comments:

Post a Comment

<< Home