The fifteen position long/short equity portfolio (shown at bottom of post) ended the week down -1.07%. The equally-weighted ten long positions contributed -2.67% for the week, but the five equally-weighted short positions returned 6.88%. Since it’s inception on May 25th, the hedged equity portfolio is up 7.13% compared to -5.45% for its benchmark, the S&P 500.

We have no reason to believe that the volatility and declines experienced over the last few weeks will subside this week. Despite some of the major indexes well into oversold territory, we feel that most investors are too cautious now to value buy at the lows. Although an interest rate cut is not likely this week, expect the markets to pay extremely close attention to the FOMC statement in an attempt to price in a cut sometime this year. If a dovish statement is released, we expect a substantial rally to ensue. Also expect to hear more news of hedge fund collapses which will continue to fuel the sell-off.

Unfortunately the bulls are running out of ammunition with only 33 companies from the S&P 500 scheduled to report earnings next week. Out of all the S&P 500 companies, 408 have so far reported earnings with 66% beating estimates. The year-over-year earnings growth rate has risen to 7% in the past week, up from 5.8% the previous week. Despite the strong earnings growth and relatively-sound economy, the reduced liquidity coupled with the fear of sub-prime contagion into other market segments is too much to bear for most investors.

Our Major Market Model remains Bearish as of May 15th 2007. Both the Technical and Sentiment components are firmly bearish, while the Trend component maintains it’s bullish stature. However, if the S&P 500 closes below 1397 expect the Trend component to turn bearish as well. We continue to recommend a defensive portfolio allocation in line with the recommendation of the AAS Market Model. The AAS Model portfolios are between 50% and 62.5% cash with the remaining allocation in either bonds, commodities or inverse funds. The total universe of stocks, ETF’s and mutual funds which we review on a daily basis is 1798. Of those reviewed, 79 are rated "Buy," 1011 are rated "Sell" and 708 "Neutral”.

As has been the case for the past several weeks, a Top Down approach does not produce any broad indices, Investment Styles or Sectors which are currently producing measurable alpha. Listed below are the top 25 AAS buy rated securities out of the 79 included in today’s newsletter:

Intuitive Surigal Inc (ISRG), Berkshire Hathaway Inc Del (BRK-B), Crocs Inc. (CROX), Precision Castparts Corp (PCP), Cummins Inc (CMI), Amazon.com Inc (AMZN), Deckers Outdoor Corp (DECK), National Oilwell Varco Inc (NOV), Apple Computers Inc (AAPL), Blue Coat Sys Inc. (BCSI), Chicago Mercantile Exchange (CME), Triumph Group Inc (TGI), Shaw Group Inc (SGR), Penford Corp (PENX), Washington Post Co Clb (WPO), Varian Semiconductor Equipment (VSEA), iShares FTSE/Xinhua China 25 (FXI), Itron Inc. (ITRI), Alliant Tech Systems Inc (ATK), Flour Corp (FLR), Oceaneering International (OII), Astec Inds Inc (ASTE), Google Inc. (GOOG), FMC Technologies Inc. (FTI) and Freeport-McMoran Copper & Gold (FCX).

Short-Term Technical Indicators

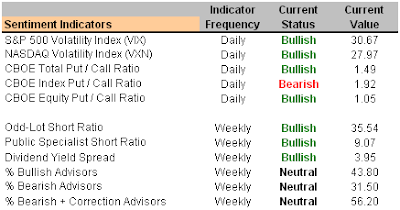

Investor Sentiment

Long-Term Market Model – Bearish since May 15, 2007

Asset Allocation Recommendation – AAS Model Portfolios are allocated at 50 - 100% cash and 25 - 50% long.

Top Alpha Generating Securities

Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top AAS Rated Major Market – Diamonds Trust, Series 1 (DIA 5/3/07)

Top AAS Rated Style-Box for Alpha – iShares Morningstar Mid Cap Growth (JKH 3/20/07)

Top AAS Rated Sector for Alpha – Internet Architecture HOLDRs (IAH 5/1/07)

Top AAS Rated Long Stocks for Alpha

Intuitive Surgical Inc. (ISRG 2/22/07)

Precision Castparts Corp. (PCP 9/20/06)

Cummins Inc. (CMI 1/31/07)

The Washington Post Co. (WPO 7/24/07)

Itron Inc. (ITRI 7/12/07)

Fluor Corp. (FLR 3/5/07)

Oceaneering International (OII 3/19/07)

Sturm, Ruger & Co. (RGR 3/8/07)

Kaman Corp. (KAMN 3/14/07)

IDXX Laboratories Inc. (IDXX 7/18/07)

Top AAS Rated Short Stocks for Alpha

LandAmerica Financial Group (LFG 7/11/07)

Beazer Homes USA Inc. (BZH 1/25/07)

Radian Group Inc. (RDN 6/7/07)

Meritage Homes Corp. (MTH 12/18/06)

Martin Marietta Materials Inc. (MLM 7/20/07)

Review of Last Week’s Top AAS Rated Stocks

Highlighted securities are additions from the prior week’s portfolio