Alpha in Transports Revisited

Three sectors that I listed as potential leaders were Transports (IYT 11/10/06), Energy (IYE) and Natural Resources (IGE). I’ve discussed alpha in Transports twice over the last month and a half, once on October 6th and again on October 23rd, listing among others Alaska Air Group (ALK 11/13/06) and JetBlue Airways Corp. (JBLU 10/17/06) as “buy” recommended companies. JBLU, as you know, is doing very well, up over 30% since I published the recommendation and nearly 37% since our “buy” recommendation.

We analyze roughly thirty-five transportation companies for alpha each day. As of this morning, twelve are “buy” recommended, fifteen are “neutral” and eight are “short/sell” recommended. Our highest-rated stocks are PACCAR Inc. (PCAR 11/10/06), AirTran Holdings Inc. (AAI 11/15/06) and Trinity Industries Inc. (TRN 10/31/06).

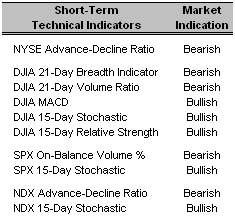

We analyze roughly thirty-five transportation companies for alpha each day. As of this morning, twelve are “buy” recommended, fifteen are “neutral” and eight are “short/sell” recommended. Our highest-rated stocks are PACCAR Inc. (PCAR 11/10/06), AirTran Holdings Inc. (AAI 11/15/06) and Trinity Industries Inc. (TRN 10/31/06). Short-Term Technical Indicators – The 15-Day Relative Strength of the DJIA continued to improve on Friday as did the MACD.

Short-Term Technical Indicators – The 15-Day Relative Strength of the DJIA continued to improve on Friday as did the MACD. Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – VIX closed at another 52-week low on Friday with a value of 10.05. A low level of volatility coupled with an increase in the percentage of bullish advisors indicates that investor sentiment is extremely bullish. Used as a contrarian indicator, such optimism and complacency should be viewed as bearish.

One of the guests this morning on CNBC made a very interesting comment suggesting that investor sentiment surveys might now be “contrarian-contrarian indicators.” Investor reverse-psychology, one would think, is hard to quantify and interpret, which is why we don’t over-weigh these surveys in our analysis.

I’m more interested in whether or not institutional investors are “putting their money where their mouths are.” I prefer to use more quantifiable measures such as traditional put/call ratios and volatility indexes as well as commercial hedges when measuring sentiment.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Date = Date of AAS “Buy” Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Core (JKJ 11/6/06)

Top Rated Sector Derivative – iShares NASDAQ Biotechnology (IBB 10/6/06)

Today’s Top “Buy” Recommended Stocks

- RTI International Metals Inc. (RTI 10/11/06)

- Daktronics Inc. (DAKT 10/31/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- Alleghany Technologies Inc. (ATI 10/5/06)

- Amazon.com Inc. (AMZN 10/9/06)

- Cephalon Inc. (CEPH 10/24/06)

- Harman International Ind. Inc. (HAR 10/9/06)

- Volt Information Sciences Inc. (VOL 11/6/06)

0 Comments:

Post a Comment

<< Home