Good Morning

Many investors are interested in pure natural gas companies but are having a hard time isolating such companies from the broad “oil and gas” market segment. Here is a helpful resource that investors might find useful in distinguishing pure natural gas companies from other energy related companies.

Tomorrow I’ll take a look at some of the pure natural gas companies that our analytic is indicating as “buy” recommended.

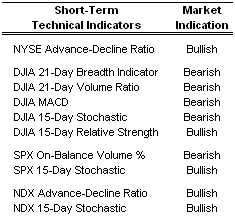

Short-Term Technical Indicators – Despite a bullish relative strength reading for the Dow, the majority of the short-term indicators are signaling that the index is weakening or at least losing momentum. However, the correction that took place in the last week of October appears to have lost its influence on the indicators.

Long-Term Market Model – Bullish since August 23rd. Several of the components of the long-term market model that were weakening over the last few weeks have stabilized and are no longer leading the model towards a bearish reading.

Long-Term Market Model – Bullish since August 23rd. Several of the components of the long-term market model that were weakening over the last few weeks have stabilized and are no longer leading the model towards a bearish reading.Investor Sentiment – A fairly substantial drop in both the VIX and VXN occurred on Friday with both volatility indexes trading well below their values one week ago.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall investment portfolio.

Date = Date of AAS “Buy” Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Core (JKJ 11/6/06)

Top Rated Sector Derivative – iShares NASDAQ Biotechnology (IBB 10/6/06)

Today’s Top “Buy” Recommended Stocks

- RTI International Metals Inc. (RTI 10/11/06)

- Harman International Industries Inc. (HAR 10/9/06)

- Gymboree Corp. (GYMB 9/28/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Sears Holding Corp. (SHLD 9/19/06)

- Astec Industries Inc. (ASTE 10/23/06)

- Group 1 Automotive (GPI 10/30/06)

- Robbins & Myers Inc. (RBN 10/16/06)

- Manitowoc Co. Inc. (MTW 8/10/06)

- Urban Outfitters Inc. (URBN 11/8/06)

0 Comments:

Post a Comment

<< Home