Politics and Biotech

I don’t really care for the debate on whether Democratic control of the House will impact prescription drugs or whether stem cell research will now be funded accordingly. At this point, it’s too early to predict the legislative agenda anyway. One of the big benefits of being a quant investor is not having to factor politics into the investment selection process. Our view is that the “efficient” market prices in all relevant information.

I don’t really care for the debate on whether Democratic control of the House will impact prescription drugs or whether stem cell research will now be funded accordingly. At this point, it’s too early to predict the legislative agenda anyway. One of the big benefits of being a quant investor is not having to factor politics into the investment selection process. Our view is that the “efficient” market prices in all relevant information.With that being said, an interesting stock that was upgraded to “buy” recommended status from “neutral” on Monday is Enzo Biochem Inc. (ENZ 10/9/06). The initial “buy” recommendation took place on October 9th but ENZ has shifted to "neutral" or "hold" status several times since then. Enzo participates in the R&D, manufacturing and marketing of diagnostic and research products based on genetic engineering, biotech and molecular biology. Its products relate to the diagnosis of infectious diseases, cancers, genetic defects and other diagnostic information.

As you can see, the stock is trading not only below it's recent high, but well below it's highs back in 2005. If biotech continues to generate alpha, a stock like ENZ might be worth looking at.

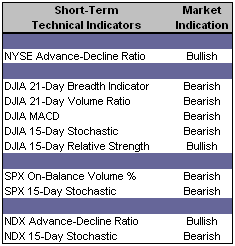

As you can see, the stock is trading not only below it's recent high, but well below it's highs back in 2005. If biotech continues to generate alpha, a stock like ENZ might be worth looking at.Short-Term Technical Indicators – Our data vendor finally got everything worked out. As you can tell, most of the indicators are bearish at the moment.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX and the Index Put/Call Ratio traded lower yesterday. There was a modest percentage decline in both Bullish and Bearish advisors with the difference between the two continuing to march toward bearish territory.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall investment portfolio.

Date = Date of AAS “Buy” Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Growth (JKK 11/6/06)

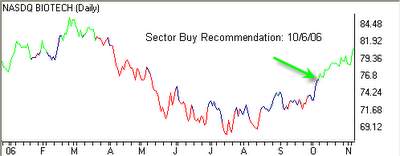

Top Rated Sector Derivative – iShares NASDAQ Biotechnology (IBB 10/6/06)

Today’s Top “Buy” Recommended Stocks

- RTI International Metals Inc. (RTI 10/11/06)

- Harman International Industries Inc. (HAR 10/9/06)

- Veritas DGC Inc. (VTS 7/28/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Allegheny Technologies Inc. (ATI 10/5/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- Sequa Corp. (SQA-A 10/5/06)

- Centene Corp. (CNC 10/20/06)

- Robbins & Myers Inc. (RBN 8/10/06)

- Ceradyne Inc. (CRDN 11/1/06)

- Apollo Group Inc. (APOL 10/13/06)

- Whole Foods Market Inc. (WFMI 11/2/2006)

- Hansen Natural Corp. (HANS 8/4/06)

- Red Robin Gourmet Burgers Inc. (RRGB 11/2/06)

- Express Scripts Inc. (ESRX 9/22/06)

2 Comments:

CRDN what will sustain this company's growth as Iraq troop deployment is reduced. Less soliders means less armor doesn't it???

By Anonymous, at 9:52 AM

Anonymous, at 9:52 AM

Well for starters a $122 million order for armor taken out by the Army last week, with more orders to come through the end of the year.

But I'm a quant investor and as such I don't factor in political speculation into the process. We like CRDN for technical reasons.

Logically, your point makes sense. If the troops leave Iraq, who needs the body armor? But I'd be careful to correlate military/government spending with logic.

By Justin, at 11:05 AM

Justin, at 11:05 AM

Post a Comment

<< Home