Pure Natural Gas

But despite Energy being our top sector today, I’m more interested in Natural Resources, specifically Natural Gas. My interest in the commodity can be explained by looking at the graph below. Obviously I’m not banking on natural gas returning to levels seen this time last year, although anything’s possible I suppose. But we’re not even at the levels seen in 2004 yet.

Not only that, but there’s a large percentage of hedge funds still licking their wounds from the losses experienced this summer. Although I don’t know for sure, it wouldn’t surprise me if they’re speculating on natural gas already. If so, a fairly significant run-up is certainly possible, especially if the weather in the Northeast shows some semblance of normalcy.

Often times it’s difficult to isolate pure natural gas companies from those under the broad “oil and gas” umbrella. I spent some time yesterday and this morning doing just that and have narrowed the list down to eight “buy” recommended, natural gas companies. There are probably other good ones out there, but I only took those that are included in our daily analysis and provided to our subscribers.

Often times it’s difficult to isolate pure natural gas companies from those under the broad “oil and gas” umbrella. I spent some time yesterday and this morning doing just that and have narrowed the list down to eight “buy” recommended, natural gas companies. There are probably other good ones out there, but I only took those that are included in our daily analysis and provided to our subscribers.- Atmos Energy Corp. (ATO 11/1/06)

- New Jersey Resources Corp. (NJR 11/10/06)

- Nicor Inc. (GAS 11/3/06)

- Nisource Inc. (NI 10/23/06)

- ONEOK Inc. (OKE 11/9/06)

- Piedmont Natural Gas Co. Inc. (PNY 11/8/06)

- Southwest Gas Corp. (SWX 11/9/06)

- WGL Holdings Inc. (WGL 11/13/06)

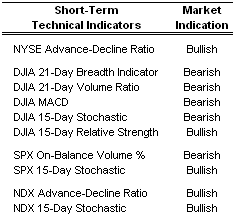

Short-Term Technical Indicators – The 15-Day stochastic Indicator for the NASDAQ is growing increasingly bullish each day. However, the 15-day stochastic indicator for the Dow continues to move away from 80, which can be interpreted as a short-term sell signal.

Short-Term Technical Indicators – The 15-Day stochastic Indicator for the NASDAQ is growing increasingly bullish each day. However, the 15-day stochastic indicator for the Dow continues to move away from 80, which can be interpreted as a short-term sell signal. Long-Term Market Model – Bullish since August 23rd. The modest weakening observed over the last few weeks in some of the components of the model has ceased and in some cases reversed direction and begun to strengthen again.

Long-Term Market Model – Bullish since August 23rd. The modest weakening observed over the last few weeks in some of the components of the model has ceased and in some cases reversed direction and begun to strengthen again.Investor Sentiment – VIX and VXN edged higher yesterday but are still trading well below last week’s reading. With the Put/Call ratio declining by 0.19, or nearly 20%, institutional investors still feel the markets will move higher.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall investment portfolio.

Date = Date of AAS “Buy” Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Core (JKJ 11/6/06)

Top Rated Sector Derivative – iShares Dow Jones U.S. Energy (IYE 11/10/06)

Today’s Top “Buy” Recommended Stocks

- RTI International Metals Inc. (RTI 10/11/06)

- Allegheny Technologies Inc. (ATI 10/5/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Robbins & Myers Inc. (RBN 10/16/06)

- Harman International Industries Inc. (HAR 10/9/06)

- Apollo Group Inc. (APOL 10/13/06)

- Hansen Natural Corp. (HANS 8/4/06)

- Whole Foods Market Inc. (WFMI 11/2/2006)

- Intuitive Surgical Inc. (ISRG 10/27/06)

- SanDisk Corp. (SNDK 10/20/06)

0 Comments:

Post a Comment

<< Home