Global Alpha

You’ll notice at the bottom of the post that four of our top five “buy” recommended ETF’s this morning are international. I noted way back in early-October that we were seeing opportunity develop in Europe. One of the ETF’s I mentioned in that post was the iShares MSCI Spain Index (EWP 8/4/2006), which is also listed below. Our analytic upgraded that ETF to “buy” recommended status on August 4th, 2006, and since then we’ve seen the ETF gain nearly 20%.

Two of the international ETF’s listed below were upgraded to “buy” recommended status within the last two weeks. In fact, the Model ETF Portfolio we provide to our subscribers just recently shifted some of its allocation to international investments.

Two of the international ETF’s listed below were upgraded to “buy” recommended status within the last two weeks. In fact, the Model ETF Portfolio we provide to our subscribers just recently shifted some of its allocation to international investments. I’m very interested in the iShares MSCI South Africa Index (EZA 11/10/06) not only because it’s trading below a recent high, but because it just crossed over its 200-day moving average. Graphs like the one below are exciting because they indicate the beginning of a trend with room to grow.

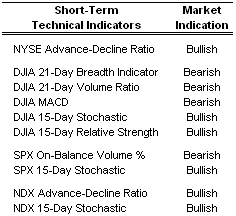

Short-Term Technical Indicators – The 21-Day Volume and Breadth indicators for the Dow are still well below levels seen just two weeks ago. These indicators are designed to turn bearish when new index highs are reached without new breadth and volume highs, as is the case currently.

Short-Term Technical Indicators – The 21-Day Volume and Breadth indicators for the Dow are still well below levels seen just two weeks ago. These indicators are designed to turn bearish when new index highs are reached without new breadth and volume highs, as is the case currently. But, what I and many other technical investors have observed lately is that the rally doesn’t really care what the technicals are saying. So basically I’m still watching them for discipline sake.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – Another significant and confounding drop in VIX and VXN took place yesterday. Both are trading well below last weeks levels and the VIX is only 0.23 away from its 52-week low.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall investment portfolio.

Date = Date of AAS “Buy” Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Core (JKJ 11/6/06)

Top Rated Sector Derivative – iShares NASDAQ Biotechnology (IBB 10/6/06)

Today’s Top “Buy” Recommended Stocks

- RTI International Metals Inc. (RTI 10/11/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Gymboree Corp. (GYMB 9/28/06)

- Harman International Industries Inc. (HAR 10/9/06)

- Allegheny Technologies Inc. (ATI 10/5/06)

- Apollo Group Inc. (APOL 10/13/06)

- Hansen Natural Corp. (HANS 8/4/06)

- Whole Foods Market Inc. (WFMI 11/2/2006)

- Carpenter Technology Corp. (CRS 10/26/06)

- Intuitive Surgical Inc. (ISRG 10/27/06)

0 Comments:

Post a Comment

<< Home