Energy and Natural Gas

What’s interesting to me is that the energy sector is doing so well despite the price of crude. I guess I used to associate the performance of oil companies with the price of oil, which apparently is erroneous. Indeed, the sector deteriorates when crude turns bearish, which is to be expected. But we don’t need a bullish trend in oil in order for the sector itself to trend and generate alpha. And since commodities have a tendency to ebb and flow, the next time we see a big drop in crude prices might prove an opportune time for a speculative position in an energy company.

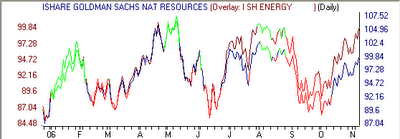

What’s interesting to me is that the energy sector is doing so well despite the price of crude. I guess I used to associate the performance of oil companies with the price of oil, which apparently is erroneous. Indeed, the sector deteriorates when crude turns bearish, which is to be expected. But we don’t need a bullish trend in oil in order for the sector itself to trend and generate alpha. And since commodities have a tendency to ebb and flow, the next time we see a big drop in crude prices might prove an opportune time for a speculative position in an energy company. Not so for utility and natural gas companies. The Natural Resources (IGE) derivative started to recover in early-October, right around the time that natural gas bounced off its low’s. This makes more sense.

Not so for utility and natural gas companies. The Natural Resources (IGE) derivative started to recover in early-October, right around the time that natural gas bounced off its low’s. This makes more sense. So is now a good time to look for alpha in the energy and natural resources sectors? I think so. We still don’t have “buy” recommendations on these sectors yet, but we’re getting very close. I’m running out of time today, but tomorrow I’ll list a few “buy” recommended energy and natural resource companies that might be worth watching.

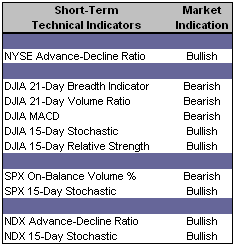

So is now a good time to look for alpha in the energy and natural resources sectors? I think so. We still don’t have “buy” recommendations on these sectors yet, but we’re getting very close. I’m running out of time today, but tomorrow I’ll list a few “buy” recommended energy and natural resource companies that might be worth watching.Short-Term Technical Indicators – The majority of the Dow Jones Industrial Average indicators are bearish and half of the S&P 500 indicators are bearish. However, it appears that the impact of last week’s broad-based declines is wearing off.

The DJIA Breadth and Volume Indicators won’t turn bullish until they close higher than their respective values of October 26th. Right now they’re well off those levels, even as the Dow closes at record highs, which is regarded as short-term bearish. The MACD appears to be primed to cross back over its 9-Day Moving Average within days and turn bullish, assuming the markets continue to trend.

The S&P 500 On-Balance Volume % Indicator won’t turn bullish until it closes higher than it did on October 31st.

Long-Term Market Model – Bullish since August 23rd. We continue to see modest weakening in some components of the long-term market model, although the magnitude of the daily change is much smaller than last week. It’s possible for the model to reverse direction and begin to strengthen again if the markets have another solid day.

Long-Term Market Model – Bullish since August 23rd. We continue to see modest weakening in some components of the long-term market model, although the magnitude of the daily change is much smaller than last week. It’s possible for the model to reverse direction and begin to strengthen again if the markets have another solid day.Investor Sentiment – Despite the election and the consequent shift of power, volatility remains at very, very low levels. The VIX closed at 10.75, only 0.48 away from its 52-week low. The VXN (NASDAQ Volatility Index) also traded lower and closed at 16.39. Both the Total and Index Put/Call Ratios closed lower than Tuesday’s level, which means investors are expecting the markets to continue to move higher.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall investment portfolio.

Date = Date of AAS “Buy” Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Core (JKJ 11/6/06)

Top Rated Sector Derivative – iShares NASDAQ Biotechnology (IBB 10/6/06)

Today’s Top “Buy” Recommended Stocks

- RTI International Metals Inc. (RTI 10/11/06)

- Veritas DGC Inc. (VTS 7/28/06)

- Harman International Industries Inc. (HAR 10/9/06)

- Allegheny Technologies Inc. (ATI 10/5/06)

- Gymboree Corp. (GYMB 9/28/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Group 1 Automotive (GPI 10/25/06)

- Astec Industries Inc. (ASTE 10/23/06)

- Manitowoc Co. Inc. (MTW 8/14/06)

- Apollo Group Inc. (APOL 10/13/06)

- Whole Foods Market Inc. (WFMI 11/2/2006)

- Red Robin Gourmet Burgers Inc. (RRGB 11/2/06)

- Express Scripts Inc. (ESRX 9/22/06)

- SanDisk Corp. (SNDK 10/20/06)

Today’s Top “Buy” Recommended Fidelity Select Mutual Funds

2 Comments:

I have to say great blog, but I am curious how you can achieve portable alpha in its truest sense without the use of total return swaps. Last I checked swaps were a little out of range for the average retail investor.

By Anonymous, at 6:10 PM

Anonymous, at 6:10 PM

Thanks Econ Updater and you're right. Portable Alpha in its "truest" sense, as designed by the academics, involves utilizing exotic strategies to expose the portfolio to beta as cheaply as possible. Typically this involves swaps, which as you mentioned are well out of the realm of retail investors and more in the hands of institutional managers and hedge funds. Additionally, leverage can be accomplished by using a multiple in the swap providing significantly greater exposure. But how cheap is the beta if you're losing anywhere from 1-5% of the return to management fees?

And who's to say that swaps are the only way to achieve cheap beta? An index ETF provides cheap beta and it's a tool that most retail investors are comfortable with. Granted an index ETF may not be as cheap as a total return swap, but it's cheap none the less, and far less expensive than investing in an index correlated mutual fund for beta.

As with all investment strategies, we don't feel that there is a "best" way to achieve portable alpha. There are many ways to port alpha onto beta, especially now that there are a gazillion ETF's available. We aim at providing a practical approach to portable alpha, which we think can be achieved without the use of exotic strategies.

Great question!

By Justin, at 7:51 AM

Justin, at 7:51 AM

Post a Comment

<< Home