Migrating Markets

We’ve seen elevated vacillation in our sector analysis this week, which is evident in my blog posts. Although confusing at times, I generally view this as a good thing because it indicates that the market is establishing leadership…or trying to at least. The vision that comes to mind as I write this is the “flying v” formation of geese (whom I loathe) migrating south. There is always one goose in the front, but never indefinitely, and the rest of the flock (or gaggle maybe?) each take turns leading.

When no goose wants to take the lead, the flock stops for a bit, craps all over everything in sight, and then takes off again. Basically the market does the same thing. Tech, Financials, and a few other sectors have done their part to get us here, but new leadership could fuel this rally through the year. Transports maybe? Energy? We'll have to wait to see.

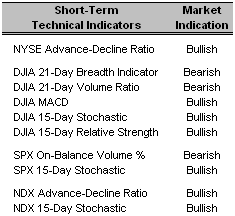

Short-Term Technical Indicators – The DJIA MACD did indeed cross back over its 9-Day MA, which is a bullish indication.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX closed yesterday at a new 52-week low. Actually, it closed over 1% lower than the previous low of 10.27. But the Put/Call Ratio also decreased, meaning investors are speculating that the market will continue to move higher. Mixing extreme optimism and extreme complacency, ahead of options expiration no less, makes for a very dangerous cocktail.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Date = Date of AAS “Buy” Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Core (JKJ 11/6/06)

Top Rated Sector Derivative – iShares Dow Jones Transports (IYT 11/10/06)

Today’s Top “Buy” Recommended Stocks

- RTI International Metals Inc. (RTI 10/11/06)

- Daktronics Inc. (DAKT 10/31/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- Volt Information Sciences Inc. (VOL 11/6/06)

- Carpenter Technology Corp. (CRS 10/26/06)

- Whole Foods Market Inc. (WFMI 11/2/2006)

- Apollo Group Inc. (APOL 10/13/06)

- Intuitive Surgical Inc. (ISRG 10/27/06)

- Hansen Natural Corp. (HANS 8/4/06)

0 Comments:

Post a Comment

<< Home