Daktronics Inc. (DAKT)

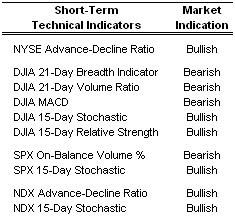

Short-Term Technical Indicators – It looks as though the DJIA MACD is about to cross back over its 9-Day MA, perhaps after today’s close. That will shift the MACD indicator back to a bullish reading. Unfortunately, the Breadth and Volume ratios have quit a bit of ground to cover before they turn bullish.

Short-Term Technical Indicators – It looks as though the DJIA MACD is about to cross back over its 9-Day MA, perhaps after today’s close. That will shift the MACD indicator back to a bullish reading. Unfortunately, the Breadth and Volume ratios have quit a bit of ground to cover before they turn bullish. Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – VIX is only .04 away from the 52-week low that occurred on 12/23/2005 and screaming “overbought.” The problem is that no one is listening anymore.

Adam, who has as good of an understanding of options and volatility trading as anyone, has been tracking the VIX for awhile now and comments just about daily on it’s continual slide. He’s got a great site for those looking to learn about options and add another element to their investment strategy. Not only that, but he’s entertaining too. Check it out if you haven’t already.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Date = Date of AAS “Buy” Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Core (JKJ 11/6/06)

Top Rated Sector Derivative – iShares NASDAQ Biotechnology (IBB 10/6/06)

Today’s Top “Buy” Recommended Stocks

- Daktronics Inc. (DAKT 10/31/06)

- RTI International Metals Inc. (RTI 10/11/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Volt Information Sciences Inc. (VOL 11/6/06)

- Harman International Industries Inc. (HAR 10/9/06)

- Apollo Group Inc. (APOL 10/13/06)

- Whole Foods Market Inc. (WFMI 11/2/2006)

- Hansen Natural Corp. (HANS 8/4/06)

- Carpenter Technology Corp. (CRS 10/26/06)

- Intuitive Surgical Inc. (ISRG 10/27/06)

0 Comments:

Post a Comment

<< Home