Check out Wallstrip

But the best part of Wallstrip in my opinion, is that they’ve brought together twelve of the most respected investment bloggers to create a rolling conversation for each company. This is where you’ll find ample fundamental or technical analysis as well as a good dose of humor. At the very least, this is an entertaining site, but I think that investors will find enough solid analysis to make it worth their time.

Now, in terms of portable alpha, our analysis indicates it’s time to put financials on the back burner and find other market segments generating alpha. That doesn’t mean sell financials yet, which as of this morning are only recommended “neutral.” It just means to look for other sectors.

Just about every tech sector is doing well, which is no surprise at this point. It's not too late to get into tech, but I really think that if you haven’t done so already, investing in one or two energy, natural resources or basic materials holdings might be a good idea. We don’t yet have “buy” recommendations on the Energy (IYE) or Natural Resources (IGE) sectors, but Basic Materials (IYM) is a “buy.” Stick with mutual funds or ETF’s for the time being, and don’t be too aggressive with the allocation. The Vanguard Materials ETF (VAW) is highly rated this morning followed by the iShares Dow Jones U.S. Basic Materials ETF (IYM).

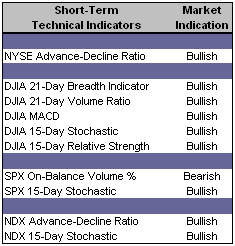

Short-Term Technical Indicators – Nine of the ten continue to be bullish. The S&P 500 On-Balance Volume % indicator, after a one-day pause in its decline, picked up again Monday with weakening values.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX and VXN edged up modestly yesterday while all three Put / Call ratios slipped lower.

Asset Allocation – 75% to 85% invested within the actively-managed portion of the overall investment portfolio. 15% to 25% in cash or bonds.

Top Rated Major Market Derivative – Fidelity NASDAQ Composite Index (ONEQ)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ)

Top Rated Sector Derivative – iShares Goldman Sachs Software (IGV)

Today’s Top “Buy” Recommended Stocks

- Allegheny Technologies Inc. (ATI)

- CPI Corp. (CPY)

- Gymboree Corp. (GYMB)

- JLG Industries Inc. (JLG)

- Rogers Corp. (ROG)

0 Comments:

Post a Comment

<< Home