Alpha Not in All Tech Sectors

Here’s an interesting stock that was upgraded to a “buy” recommended security this morning: Potlatch Corp. (PCH). Not only is it a REIT, but it owns and manages timberlands that operate in five segments: New Resources, New Land Sales and Development, Wood Products, Pulp and Paperboard and Consumer Products. With Real Estate (IYR) our second-highest rated sector derivative and Natural Resources (IGE) out-performing every sector except for Energy (IYE) this week, this could be a decent alpha producing security.

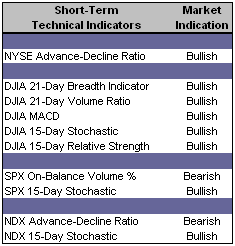

Short-Term Technical Indicators – The 15-Day Stochastic indicators on both the S&P 500 and the NASDAQ weakened overnight. Although the value for the S&P remains well entrenched in “bullish” territory, the value for the NASDAQ is closing in on 80. If the value crosses from above 80 to below 80, it is considered a short-term “sell” signal.

Short-Term Technical Indicators – The 15-Day Stochastic indicators on both the S&P 500 and the NASDAQ weakened overnight. Although the value for the S&P remains well entrenched in “bullish” territory, the value for the NASDAQ is closing in on 80. If the value crosses from above 80 to below 80, it is considered a short-term “sell” signal. Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX and VXN retreated modestly on Wednesday while all three Put / Call Ratios edged higher. The VIX, with a value of 11.34, remains at a very low level and close to its 52-week low of 10.27.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall investment portfolio.

Top Rated Major Market Derivative – Russell 2000 (IWM)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ)

Top Rated Sector Derivative – iShares NASDAQ Biotechnology (IBB)

Today’s Top “Buy” Recommended Stocks

- CPI Corp. (CPY)

- Allegheny Technologies Inc. (ATI)

- JLG Industries Inc. (JLG)

- Gymboree Corp. (GYMB)

- Piper Jaffray Companies (PJC)

0 Comments:

Post a Comment

<< Home