Small Caps Take Control

Investors looking for beta should at least include the Russell 2000 (IWM) or the S&P 600 (IJR) in their portfolios. We feel that this rally will continue with broad-based market participation, not just on the Large Cap side. The big financials have been leading the market since the late-summer rally began. But we think that they’re influence is just about maxed out for awhile. And with crude continuing its bearish slide, Big Oil is likely out of the picture. With both financial and oil companies taking a breather, it’s much harder for the large cap indexes to outperform. Luckily, the mid- and small-caps are in a position to take the baton.

In terms of style-box investments, Small Cap Core (JKJ) and Small Cap Growth (JKK) are the strongest. Investors can use style-box derivatives as either more focused sources of beta, or as a tool for narrowing down alpha investments. Biotechnology (IBB) is our highest-rated sector for alpha generation, followed by Real Estate (IYR), Software (IGV) and Technology (IYW).

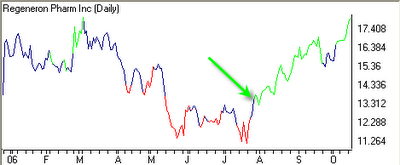

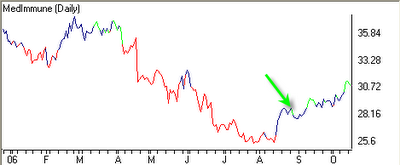

Three of our top-rated biotechnology stocks are Regeneron Pharmaceuticals Inc. (REGN), MedImmune Inc. (MEDI) and PDL BioPharma Inc. (PDLI). The green arrow represents the date we got a "buy" recommendation on the security.

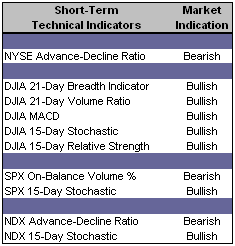

Short-Term Technical Indicators – Yesterday’s market declines translated into bearish shifts for the Advance / Decline ratios of the NYSE and the NASDAQ.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX and VXN as well as all three Put / Call ratios increased on Tuesday. In fact, all but the Equity Put / Call ratio are higher than last week’s value. The percentage of bullish investors appears to be leveling, while the percentage of bearish investors continues to decrease.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall investment portfolio.

Top Rated Major Market Derivative – Russell 2000 (IWM)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ)

Top Rated Sector Derivative – iShares NASDAQ Biotechnology (IBB)

Today’s Top “Buy” Recommended Stocks

- Allegheny Technologies Inc. (ATI)

- CPI Corp. (CPY)

- Gymboree Corp. (GYMB)

- JLG Industries Inc. (JLG)

- Rogers Corp. (ROG)

0 Comments:

Post a Comment

<< Home