Is Energy Next?

It’s hard to find a market segment that isn’t at least moving in the right direction. Even Energy (IYE) and Natural Resources (IGE) are having a decent week. We don’t have any “buy” recommendations within those sectors yet, but if the snow storm in Buffalo is any indication of what this winter will be like, we might begin to see some alpha in energy…and soon.

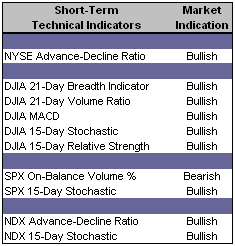

Short-Term Technical Indicators – S&P On-Balance Volume % continues to weaken for the fifth day in a row…but that’s about it.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX and VXN continue to trade at low levels. Nothing seems to spook investors, not OPEC, not planes hitting buildings, nothing.

Asset Allocation – 75% to 85% invested within the actively-managed portion of the overall investment portfolio. 15% to 25% in cash or bonds.

Top Rated Major Market Derivative – Fidelity NASDAQ Composite Index (ONEQ)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ)

Top Rated Sector Derivative – iShares Goldman Sachs Software (IGV)

Today’s Top “Buy” Recommended Stocks

- Allegheny Technologies Inc. (ATI)

- Gymboree Corp. (GYMB)

- Carpenter Technology Corp. (CRS)

- Goldman Sachs Groups Inc. (GS)

- Rogers Corp. (ROG)

0 Comments:

Post a Comment

<< Home