Alpha in a Consolidation Period

Generating alpha over the last few weeks has been difficult, not because there are no buying opportunities, but because the markets, or beta, have been on fire. With nearly double-digit returns over the last three months, even the best investors have a hard time improving upon that with a diversified strategy. But that’s a good problem to have as a portable alpha investor.

I think the portable alpha environment is on the brink of getting a whole lot more interesting. For those comfortable with short-term trading, you might look to capitalize on any consolidation that could take place either by buying put options or maybe going so far as to buy index inverse funds when it becomes clear that the markets are taking a breather. Our alpha analytics are more intermediate-term in nature, so you won’t get any recommendations from us on that front unless the consolidation last’s longer than expected. This is all speculation at this point, since I don’t have any evidence within our analytics yet that the markets are going to correct. But it’s always a good idea to plan ahead and be prepared to move if things get a little hairy.

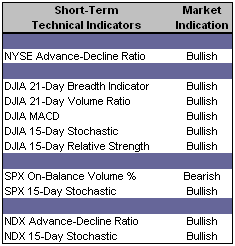

Short-Term Technical Indicators – The recent decline of the S&P 500 On-Balance Volume % indicator finally came to a halt on Friday after five consecutive days of lower readings. This indicator remains bearish however because its last value of 371.36 is still below its recent high of 391.67. As I’ve mentioned before, a new S&P 500 high that doesn’t have a corresponding On-Balance Volume % high is viewed as short-term bearish.

With overbought conditions abound, I’m looking for any early indications that market consolidation is beginning. A brief period of consolidation would not be enough to change my market out-look or long-term market model, but it’s always beneficial to have a good idea of what the markets are doing and minimize any surprises.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – There was a moderate drop in the VIX and the Index Put / Call ratio on Friday. The VIX remains bearish with a value of 10.75, now at its lowest level since March 14, 2006. This indicates an elevated level of complacency in the market, which is normally a pre-curser to a decline.

Asset Allocation – 75% to 85% invested within the actively-managed portion of the overall investment portfolio. 15% to 25% in cash or bonds.

Top Rated Major Market Derivative – Fidelity NASDAQ Composite Index (ONEQ)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ)

Top Rated Sector Derivative – iShares Goldman Sachs Software (IGV)

Today’s Top “Buy” Recommended Stocks

0 Comments:

Post a Comment

<< Home