Basic Materials

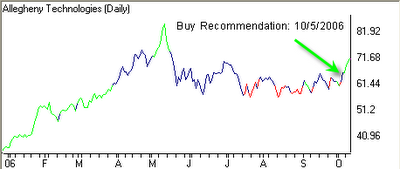

There are two steel producing companies that investors should look at within the basic materials sector for alpha. I’ve listed the first, Allegheny Technologies (ATI), as one of our Top “Buy” Recommended Stocks for several days now. ATI has been range bound since early-July, but it was recently up-graded to a “Buy” recommended stock and included in our Model Stock Portfolio.

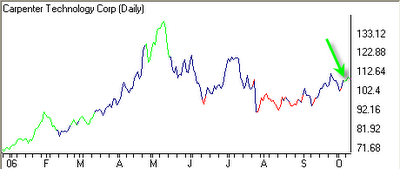

Another steel producer is Carpenter Technology Corp. (CRS) which was also upgraded on October 5th and recently added to the Model Stock Portfolio. Both of these securities are trading well below their 52-week high and appear to be developing a good bullish trend.

Another steel producer is Carpenter Technology Corp. (CRS) which was also upgraded on October 5th and recently added to the Model Stock Portfolio. Both of these securities are trading well below their 52-week high and appear to be developing a good bullish trend.

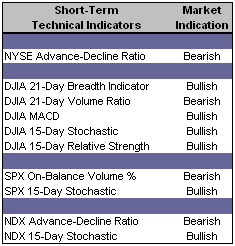

Short-Term Technical Indicators – Six of the ten short-term, technical indicators are bullish after yesterday.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX as well as both the Total Put / Call Ratio and the Index Put / Call Ratio moved up yesterday. Despite an increase in volatility yesterday, both the VIX and VXN are below levels from one week ago. Several investor sentiment polls are indicating a growing bullish percentage among the investment community. We’re seeing a level of complacency in the market that is beginning to make us uncomfortable. With that being said, we’re going to ride this up-trend as long as we can.

Asset Allocation – 75% to 85% invested within the actively-managed portion of the overall investment portfolio. 15% to 25% in cash or bonds.

Top Rated Major Market Derivative – Fidelity NASDAQ Composite Index (ONEQ)

Top Rated Style-Box Derivative – Morningstar Large Cap Core (JKD)

Top Rated Sector Derivative – iShares Goldman Sachs Software (IGV)

Today’s Top “Buy” Recommended Stocks

- CPI Corp. (CPY)

- Allegheny Technologies Inc. (ATI)

- Gymboree Corp. (GYMB)

- Rogers Corp. (ROG)

- Goldman Sachs Groups Inc. (GS)

0 Comments:

Post a Comment

<< Home