Alpha Remains in Small Caps

Over the last week the Russell 2000 (IWM) gained 3.84%. Looking back further to a one month price change, IWM is up 4.95%. Another derivative, the S&P 600 Small Cap (IJR), is up 3.38% for the week and 4.15% for the month.

Compare that to the S&P 500 (IVV) derivative which has gained 1.55% for the week and 3.67% for the month. Even the Dow Jones Industrial Diamond Trust (DIA) is under-performing small-caps, with a gain of 1.71% for the week and 4.17% for the month.

Looking at style-box investments, Large Cap Core (JKD) is still our strongest, but only by the smallest of margins. On its heels are Small Cap Core (JKJ) and then Small Cap Value (JKL), up 3.47% and 2.96% respectively.

Consider this, of the top ten long stocks listed in today’s Alpha Advisor Service newsletter, six belong to the S&P 600. Those six have an average return over the last one week of 3.70%. More impressive is that over the last one month, those six stocks have an average return of 20.04%.

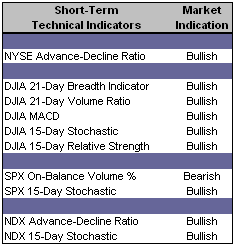

Short-Term Technical Indicators – Nine of the ten short-term, technical indicators are bullish. The only bearish indicator is the S&P 500 On-Balance Volume %, the value of which has declined two days in-a-row. It would be pre-mature to predict that the rally is weakening, but if we continue to see new highs for the S&P, we should continue to pay attention to this indicator for signs of slowing.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX and VXN as well as all three Put / Call ratios gained modestly on Monday. A bump in volatility is to be expected based on North Korean geo-political developments as well as OPEC concerns regarding the declining price of oil. Despite edging up, both the VIX and VXN are below levels from one week ago and much closer to their 52-week Low’s than vice versa. The Index Put / Call ratio gained the most yesterday, shifting from a value of 1.88 on Friday to 2.72 on Monday. This indicates that the volume of traded put options increased yesterday, a sign that institutional investors are expecting Index investments to move lower, perhaps due to an overbought status.

Asset Allocation – 75% to 85% invested within the actively-managed portion of the overall investment portfolio. 15% to 25% in cash or bonds.

Top Rated Major Market Derivative – Fidelity NASDAQ Composite Index (ONEQ)

Top Rated Style-Box Derivative – Morningstar Large Cap Core (JKD)

Top Rated Sector Derivative – iShares Goldman Sachs Software (IGV)

Today’s Top “Buy” Recommended Stocks

- CPI Corp. (CPY)

- Allegheny Technologies Inc. (ATI)

- Goldman Sachs Groups Inc. (GS)

- Gymboree Corp. (GYMB)

- World Acceptance Corp. (WRLD)

2 Comments:

An Anonymous Blogger left this comment that I accidentally rejected.

"Unless I've misread your post, I wonder if you're confusing alpha with beta. Alpha comes from security selection within an asset class, beta comes from the asset class itself. Isn't comparing small caps to large caps simply comparing the beta of the two market segments?"

I suppose my post was ambiguous. My intention was to point out that our analytic is finding alpha within the Small Cap market segments, in addition to Large Caps. That's why I noted that six of our top ten securities this morning belong to the S&P 600. And that investors choosing to avoid small caps at this time might be doing themselves a disservice. I hope this clears things up. Thanks for the post!

By Justin, at 3:18 PM

Justin, at 3:18 PM

Point taken, thanks for answering my question.

By Anonymous, at 4:26 PM

Anonymous, at 4:26 PM

Post a Comment

<< Home