Software and Biotech

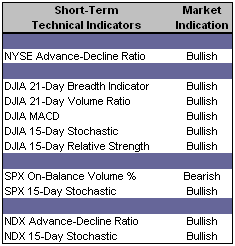

Short-Term Technical Indicators – Nine of the ten short-term, technical indicators remain bullish.

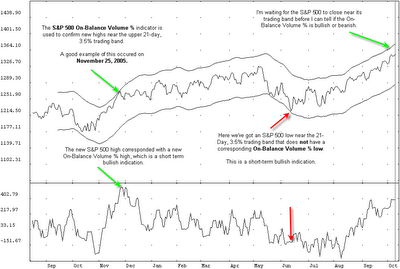

The only bearish indicator is the S&P 500 On-Balance Volume %, the value of which has declined three days in-a-row.

Long-Term Market Model – Bullish since August 23rd.

Investor Sentiment – The VIX and all three Put / Call ratios retreated yesterday while the VXN gained slightly. Market volatility remains very acceptable, although I suspect that we’ll see a bump up today due to Alcoa Inc. (AA) and Genentech Inc. (DNA). Looking at several surveys and polls, I see a continued increase in bullish investor sentiment, with some at precarious levels. We remain bullish, but the indicators within our market model have basically stopped improving, with some already beginning to retreat.

Asset Allocation – 75% to 85% invested within the actively-managed portion of the overall investment portfolio. 15% to 25% in cash or bonds.

Top Rated Major Market Derivative – Fidelity NASDAQ Composite Index (ONEQ)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ)

Top Rated Sector Derivative – iShares Goldman Sachs Software (IGV)

Today’s Top “Buy” Recommended Stocks

- CPI Corp. (CPY)

- Allegheny Technologies Inc. (ATI)

- Goldman Sachs Groups Inc. (GS)

- Rogers Corp. (ROG)

- Gymboree Corp. (GYMB)

0 Comments:

Post a Comment

<< Home