Biotechnology

Vertex Pharmaceuticals Inc. (VRTX) is our highest rated “buy” recommended Biomed/Genetics company this morning. Regeneron Pharmaceuticals Inc. (REGN) is the next highest rated followed by Amgen Inc. (AMGN). All three have recently been upgraded to “buy” recommended status, which indicates the beginning of an uptrend and increased alpha potential.

Two other Biotechnology companies worth examining are Genzyme Corp. (GENZ) and Cephalon Inc. (CEPH). Both are highly rated “neutral” recommended stocks. There’s mixed consensus on Wall Street regarding Q3 earnings for the biotech sector, but I think that a relatively small holding within the alpha component of a portfolio is a good idea.

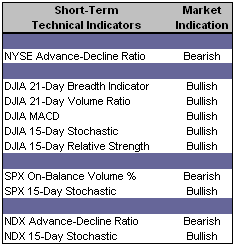

Short-Term Technical Indicators – Weaker than on Friday, but still predominantly bullish.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – Volatility, as measured by the VIX and VXN, was down on Friday. An increase in all three Put / Call ratios indicates that institutional investors were betting that the markets would go down ahead of earnings season.

Asset Allocation – 75% to 85% invested within the actively-managed portion of the overall investment portfolio. 15% to 25% in cash or bonds.

Top Rated Major Market Derivative – Fidelity NASDAQ Composite Index (ONEQ)

Top Rated Style-Box Derivative – Morningstar Large Cap Core (JKD)

Top Rated Sector Derivative – iShares Goldman Sachs Software (IGV)

Today’s Top “Buy” Recommended Stocks

2 Comments:

You use the Ultra Funds only for your Pro Funds investments?

By Larry, at 8:35 PM

Larry, at 8:35 PM

Hi Larry,

If you're asking me if we only use ProFund Ultra funds within the Model ProFund Portfolio, the answer is no. We use all ProFunds that have at least 6 months worth of price performance.

If, however, you're asking if we use ProFund Ultra Funds in other model portfolios, the answer is also no. We only use ProFunds in the ProFund model portfolio.

By Justin, at 9:21 PM

Justin, at 9:21 PM

Post a Comment

<< Home