Market Model Turns Bearish

Peaking on September 21st, the ratio continually weakened through the first week in November. At that point, it began to strengthen again until November 24th when it again began to lose ground. After yesterday’s close, the ratio is now officially in favor of NYSE issues. For bullish trends, we prefer to see dominance in the NASDAQ as opposed to the NYSE.

The issue at hand today is deciding what to do with the AAS Model Portfolios. The decision would be much easier if the markets were clearly in a bearish trend and we had “buy” recommendations on our inverse funds. Since the S&P 500 is only -0.53% away from its recent high of 1414.76, and since there are no “buy” recommended inverse funds today, our only option would be to take some profits, reduce the allocation of the portfolios and put some in cash or money market funds. Although this is certainly something that might take place next week, for today we’re going to watch the market and give it some more time.

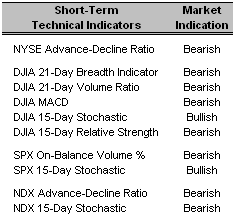

Short-Term Technical Indicators – Every single short-term technical indicator weakened after yesterday’s close.

Long-Term Market Model – Bearish since December 8th.

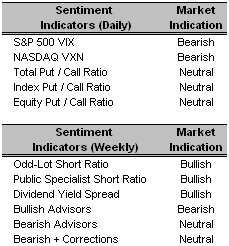

Long-Term Market Model – Bearish since December 8th.Investor Sentiment – The VIX jumped by 1.34 points yesterday, an increase of nearly 12%. It’s now at its highest level since September 11th 2006.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio. We’re prepared to reduce the allocation recommendation next week if the market continues to weaken. In all likelihood, we would move to money market vehicles before allocating into inverse funds. An allocation recommendation as low as 50% is possible.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio. We’re prepared to reduce the allocation recommendation next week if the market continues to weaken. In all likelihood, we would move to money market vehicles before allocating into inverse funds. An allocation recommendation as low as 50% is possible.Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – iShares Russell 2000 (IWM 11/6/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Core (JKJ 11/6/06)

Top Rated Sector Derivative – iShares Dow Jones Energy (IYE 11/10/06)

Today’s Top “Buy” Recommended Stocks

- Alleghany Technologies Inc. (ATI 10/5/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Daktronics Inc. (DAKT 10/31/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- Veritas DGC Inc. (VTS 7/28/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- Robbins & Myers Inc. (RBN 8/10/06)

- Manitowoc Company Inc. (MTW 8/10/06)

- Albemarle Corp. (ALB 8/9/06)

- Sequa Corporation. (SQA-A 10/5/06)

0 Comments:

Post a Comment

<< Home