Energy Bulls

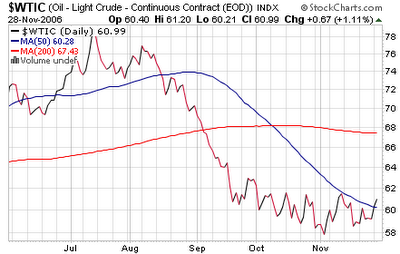

Light Crude recently crossed over its 50-Day moving average and is up today nearly $1.03 a barrel as I write this. I listed several stocks back on November 10th that investors might look to as an energy play. Those companies are included below as well as their performance since November 10th:

Light Crude recently crossed over its 50-Day moving average and is up today nearly $1.03 a barrel as I write this. I listed several stocks back on November 10th that investors might look to as an energy play. Those companies are included below as well as their performance since November 10th:- Veritas DGC Inc. (VTS 1.40%)

- Oceaneering International Inc. (OII 2.13%)

- Schlumberger LTD. (SLB 3.74%)

- World Fuel Services Corp. (INT -2.94%)

- Rowan Companies Inc. (RDC -3.45%)

- Dril-Quip Inc. (DRQ 2.79%)

- Swift Energy Co. (SFY 3.23%)

- EOG Resources Inc. (EOG 5.20%)

- Newfield Exploration Co. (NFX 12.38%)

- Pioneer Natural Resources Co. (PXD 2.30%)

The inventory report was just released, which bodes well for energy bulls. I’d like to see how our analytic reacts to today’s data before I list a few more potential alpha-generating energy companies.

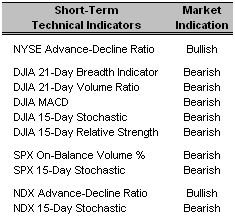

Short-Term Technical Indicators – The 15-Day Stochastic Indicator for the NASDAQ ended at 65.29 yesterday, well below the 80 point level needed for a shift from bullish to bearish territory. The Breadth and Volume Indicators for the DJIA improved significantly yesterday, as did the On-Balance Volume % of the S&P 500.

On a short-term basis, the indicators are clearly weak, but it’s certainly not cause for alarm just yet. The markets, both domestic and global, were surprisingly resilient yesterday, which lends credence to any remaining momentum.

Long-Term Market Model – Bullish since August 23rd.

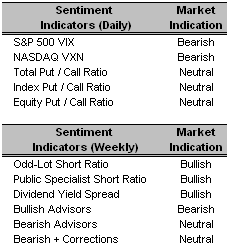

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – Investor sentiment remains mixed ahead of several significant economic reports released throughout the week. Yesterday’s session saw a decrease in both the VIX and the VXN as well as all three Put / Call ratios.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Core (JKJ 11/6/06)

Top Rated Sector Derivative – iShares Dow Jones Energy (IYE 11/10/06)

Today’s Top “Buy” Recommended Stocks

- RTI International Metals Inc. (RTI 10/11/06)

- Daktronics Inc. (DAKT 10/31/06)

- Alleghany Technologies Inc. (ATI 10/5/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- Whole Foods Market Inc. (WFMI 11/2/2006)

- The Washington Post Co. (WPO 7/5/06)

- Hansen Natural Corp. (HANS 8/4/06)

- Emmis Communications Corp. (EMMS 11/20/06)

- Red Robin Gourmet Burgers, Inc. (RRGB 11/2/06)

0 Comments:

Post a Comment

<< Home