Good Morning

Long-Term Market Model – Bullish since August 23rd.

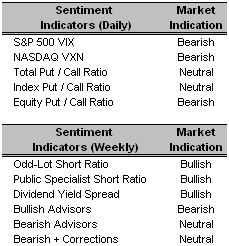

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – Both the VIX and VXN edged higher yesterday coupled with an increase in the Total and Equity Put / Call ratios. The percentage of Bullish Investment Advisors surveyed increased this week after losing ground last week. Conversely, the percentage of Bearish Advisors also increased after several weeks of stagnation.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – iShares Russell 2000 (IWM 11/6/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Core (JKJ 11/6/06)

Top Rated Sector Derivative – iShares Dow Jones Energy (IYE 11/10/06)

Today’s Top “Buy” Recommended Stocks

- Alleghany Technologies Inc. (ATI 10/5/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Daktronics Inc. (DAKT 10/31/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- Robbins & Myers Inc. (RBN 8/10/06)

- Manitowoc Company Inc. (MTW 8/10/06)

- Veritas DGC Inc. (VTS 7/28/06)

- Sequa Corporation. (SQA-A 10/5/06)

- F5 Networks Inc. (FFIV 9/20/06)

0 Comments:

Post a Comment

<< Home