Ideas for Energy Bulls

Aside from individual stocks, which I’ll get to in a bit, there are a few funds and ETF’s that investors should look at for alpha in the energy and natural resources sector. Listed below are funds that have relatively high AAS Rating Scores as well as the dates that they became “buy” recommended for our subscribers:

- Oil Service HOLDRs (OIH 11/8/06)

- ProFund Energy (ENPIX 11/10/06)

- Rydex Energy Services (RYVIX 11/9/06)

- Fidelity Energy Services (FSESX 11/9/06)

Listed below are five of our top rated stocks this morning along with their performance since the “buy” recommendation:

- Hydril Co. (HYDL 11/14/06 6.18%)

- Oceaneering International Inc. (OII 11/2/06 10.46%)

- Marathon Oil Corp. (MRO 11/8/06 7.30%)

- Cabot Oil & Gas Corp. (COG 11/13/06 11.76%)

- Southwestern Energy Co. (SWN 11/15/06 9.80%)

- Nabors Industries Ltd. (NBR)

- BJ Services Co. (BJS)

- Questar Corp. (STR)

- Baker Hughes Inc. (BHI)

- Dynergy Inc. (DYN)

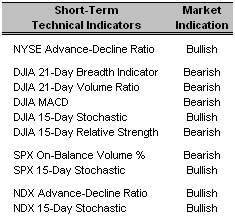

An increase in the 15-Day Stochastic indicator for the S&P 500 and the NASDAQ resulted in a shift to a bullish reading for both.

Long-Term Market Model – Bullish since August 23rd.

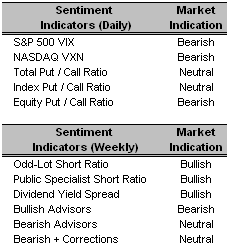

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX remains bearish despite a modest increase to 10.91 from a close of 10.83 on Wednesday.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – iShares Morningstar Mid Cap Core (JKG 11/6/06)

Top Rated Sector Derivative – iShares Dow Jones Energy (IYE 11/10/06)

Today’s Top “Buy” Recommended Stocks

- Alleghany Technologies Inc. (ATI 10/5/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Daktronics Inc. (DAKT 10/31/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Whole Foods Market Inc. (WFMI 11/2/2006)

- SanDisk Corp. (SNDK 10/20/06)

- Christopher & Banks Corp. (CBK 10/18/06)

- Emmis Communications Corp. (EMMS 11/20/06)

- Red Robin Gourmet Burgers, Inc. (RRGB 11/2/06)

0 Comments:

Post a Comment

<< Home