AAS Updates

I’ve also updated the PDF files for the five AAS Model Portfolios through the end of November. Links to these portfolios can be found in the table in the right hand margin as well. These portfolios are designed to provide our subscribers with the “alpha” component of a portable alpha portfolio.

Of course they’re not limited to only portable alpha strategies. Private and professional investors simply wanting an actively-managed portfolio can use these model portfolios in various qualified and non-qualified accounts ranging from brokerage and IRA’s to pensions, defined benefit plans and annuities.

For those of you new to the blog or to the concept of portable alpha, it refers to the strategy of porting “alpha” onto “beta.” In very simplistic terms, beta is accomplished by investing in the market as a whole as cheaply as possible. The excess capital is then allocated into alpha generating investments. Index ETF's and leveraged mutual funds are the easiest ways for do-it-yourself investors, but more advanced investors will use total return swaps, hedge fund of funds and other tools for beta.

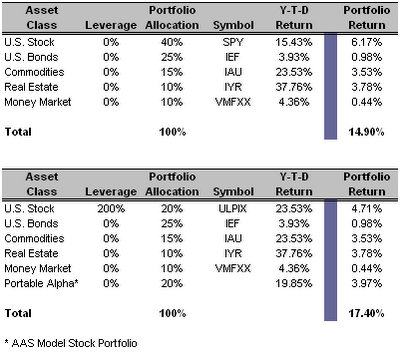

Below is a very rudimentary example of how a portable alpha portfolio can be constructed using ETF’s and leveraged mutual funds. There are all sorts of ways to change the allocation percentages around, not to mention the hundreds of ETF’s and leveraged funds available. The point is to show the potential of a portable alpha approach and how investors can implement such a strategy.

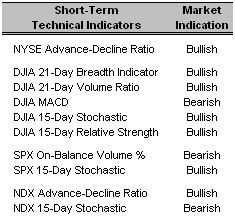

Short-Term Technical Indicators – All five short-term technical indicators for the Dow improved yesterday. The MACD is still several days removed from crossing back over its 9-day Moving Average, which would result in a shift back to bullish territory.

Short-Term Technical Indicators – All five short-term technical indicators for the Dow improved yesterday. The MACD is still several days removed from crossing back over its 9-day Moving Average, which would result in a shift back to bullish territory. Long-Term Market Model – Bullish since August 23rd.

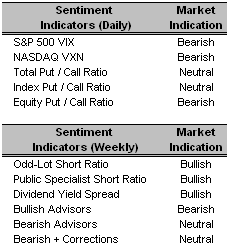

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – VIX moved marginally yesterday, but the daily sentiment indicators don’t bode well for the bulls.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – iShares Russell 2000 (IWM 11/6/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Core (JKJ 11/6/06)

Top Rated Sector Derivative – iShares Dow Jones Energy (IYE 11/10/06)

Today’s Top “Buy” Recommended Stocks

- Alleghany Technologies Inc. (ATI 10/5/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Daktronics Inc. (DAKT 10/31/06)

- Manitowoc Company Inc. (MTW 8/10/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Robbins & Myers Inc. (RBN 8/10/06)

- Cyberonics Inc. (CYBX 11/14/06)

- Sequa Corporation. (SQA-A 10/5/06)

0 Comments:

Post a Comment

<< Home