Good Morning

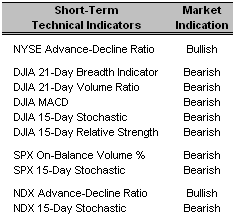

With regard to the S&P 500, the On-Balance Volume % indicator slide further into bearish territory with a value of 359.25. The On-Balance Volume % indicator is slightly different than the more common On-Balance Volume indicator since it uses the 21-Day Sum of OBV divided by the 21-Day Sum of Total Volume.

With regard to the S&P 500, the On-Balance Volume % indicator slide further into bearish territory with a value of 359.25. The On-Balance Volume % indicator is slightly different than the more common On-Balance Volume indicator since it uses the 21-Day Sum of OBV divided by the 21-Day Sum of Total Volume.Any new highs near the upper band (21-Day MA, 3.5%) made by the index need to have a corresponding OBVP value higher than 630.02, which occurred on October 31st. If we see a new index high without a new OBVP high, the trend is “technically weak” and should soon reverse direction. Currently, the SPX is trading in the middle of the band, so this indicator doesn’t really come into play just yet.

Below is an example of how an up-trend with a new SPX high near the upper band was supported by a new OBV high, extending the rally further.

Long-Term Market Model – Bullish since August 23rd.

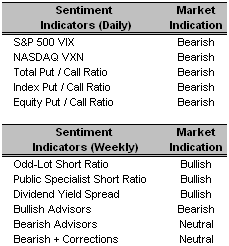

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – Yesterday’s session saw a decrease in both the VIX and the VXN as well as all three Put / Call ratios.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio. Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Core (JKJ 11/6/06)

Top Rated Sector Derivative – iShares Dow Jones Energy (IYE 11/10/06)

Today’s Top “Buy” Recommended Stocks

- Alleghany Technologies Inc. (ATI 10/5/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Daktronics Inc. (DAKT 10/31/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- The Manitowoc Co. (MTW 8/10/06)

- Whole Foods Market Inc. (WFMI 11/2/2006)

- SanDisk Corp. (SNDK 10/20/06)

- The Washington Post Co. (WPO 7/5/06)

- Emmis Communications Corp. (EMMS 11/20/06)

- Red Robin Gourmet Burgers, Inc. (RRGB 11/2/06)

0 Comments:

Post a Comment

<< Home