Bulls Show Signs of Life

For the S&P 500, the On-Balance Volume % and the 15-Day Stochastic improved, although the OBVP is still clearly entrenched in bearish territory.

Interestingly, the 15-Day Stochastic for the NASDAQ actually weakened yesterday to a value of 53.62 from 55.09 on Friday.

Long-Term Market Model – Bullish since August 23rd.

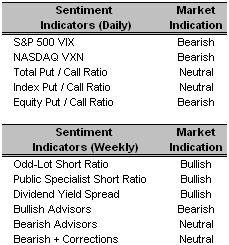

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX and VXN both lost a little ground as did the Total and Index Put / Call ratios. The only sentiment indicator increasing in value yesterday was the Equity Put / Call ratio. The bulls, showing signs of life, shook off the Pfizer (PFE short/sell 10/9/06) debacle and pulled the major averages higher.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – iShares Russell 2000 (IWM 11/6/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Core (JKJ 11/6/06)

Top Rated Sector Derivative – iShares Dow Jones Energy (IYE 11/10/06)

Today’s Top “Buy” Recommended Stocks

- Alleghany Technologies Inc. (ATI 10/5/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Daktronics Inc. (DAKT 10/31/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- The Washington Post Co. (WPO 7/5/06)

- SanDisk Corp. (SNDK 10/20/06)

- Bausch & Lomb Inc. (BOL 11/8/06)

- Christopher & Banks Corp. (CBK 10/18/06)

- Emmis Communications Corp. (EMMS 11/20/06)

0 Comments:

Post a Comment

<< Home