Alpha Remains in Utilities

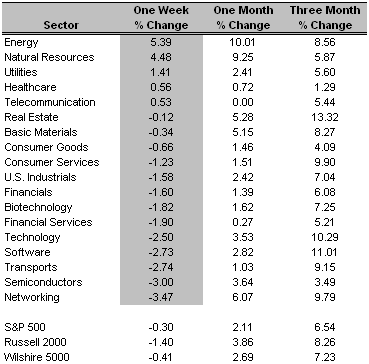

Looking at the chart below, it’s no surprise why I’ve focused on more defensive sectors of late. Energy and Natural Resources have outperformed significantly over the last one month and one week. That’s not to say that alpha isn’t present in other sectors, it’s just more obvious in energy and natural resources, at least according to our analysis.

That brings me to another alpha-producing sector: Utilities. The last time I wrote about Utilities specifically was October 25, 2006. I mentioned then that I didn’t feel it was too late to allocate into utilities since “the weather is just beginning to turn cold and natural gas is still trading very low, just recently crossing over its 200-Day MA.” The five companies listed in that post are included below, along with their performance since the October 25th post:

That brings me to another alpha-producing sector: Utilities. The last time I wrote about Utilities specifically was October 25, 2006. I mentioned then that I didn’t feel it was too late to allocate into utilities since “the weather is just beginning to turn cold and natural gas is still trading very low, just recently crossing over its 200-Day MA.” The five companies listed in that post are included below, along with their performance since the October 25th post:- Northwest Natural Gas Co. (NWN -0.53% Neutral)

- NiSource Inc. (NI 4.85% Buy)

- Southwestern Energy Co. (SWN 13.57% Buy)

- Equitable Resources Inc. (EQT 9.73% Buy)

- Peoples Energy Corp. (PGL -0.84% Neutral)

Looking at today’s analysis, I still like Utilities (IDU 11/14/06) as a “buy” recommended sector. In fact, the very same reasons why I liked it back in October apply today. Of the 81 utility companies we analyze for alpha, 46 are “buy” recommended, 28 are “neutral/hold” recommended and 7 are “short/sell” recommended.

Other than NiSource Inc. (NI 10/23/06), Southwestern Energy co. (SWN 11/15/06) and Equitable Resources Inc. (EQT 11/9/06) which are all “buy” recommended this morning, investors looking for alpha in Utilities could start with:

- El Paso Corp. (EP 11/29/06)

- PPL Corp. (PPL 11/27/06)

- ONEOK, Inc (OKE 11/9/06)

- National Fuel Gas Co. (NFG 12/1/06)

- Constellation Energy Group Inc. (CEG 11/24/06)

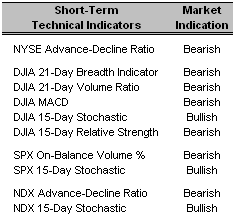

Short-Term Technical Indicators – Breadth and Volume rebounded slightly on Friday for the Dow, up from Thursday’s values. There was also a marked increase in the 15-Day Stochastic indicator. The MACD and the 15-day Relative Strength indicators slipped slightly.

Both of the S&P 500 indicators gained some ground on Friday, as did the 15-Day Stochastic for the NASDAQ. The 15-Day stochastic for all three indexes represents the only short-term bullish indicators at the moment.

Long-Term Market Model – Bullish since August 23rd.

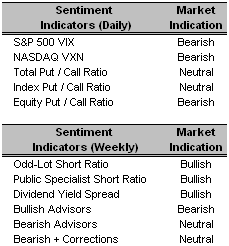

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX as well as all three Put/Call Ratios edged higher on Friday, no doubt reflecting the see-saw action of the session. All five daily sentiment indicators remain either bearish or neutral.

The Odd-Lot Short Ratio increased over the last week, as did the percentage of Bearish + Correction investment advisors. Conversely, the Public Specialist Short Ratio, the Dividend Yield Spread, and the percentage of Bullish Advisors lost ground over the last week.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – iShares Morningstar Mid Cap Growth (JKH 11/8/06)

Top Rated Sector Derivative – iShares Dow Jones Energy (IYE 11/10/06)

Today’s Top “Buy” Recommended Stocks

- Alleghany Technologies Inc. (ATI 10/5/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Daktronics Inc. (DAKT 10/31/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- Manitowoc Company Inc. (MTW 8/10/06)

- Volt Information Sciences Inc. (VOL 11/6/06)

- Albemarle Corp. (ALB 8/9/06)

- Cyberonics Inc. (CYBX 11/14/06)

0 Comments:

Post a Comment

<< Home